GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Finding it hard to keep pace with your business accounts in the current dynamic environment in the U.S. market? You are not alone. Due to increasing labour costs, staffing shortages, and the pressure to comply with U.S. tax laws, most American small-sized and mid-sized business establishments struggle to keep their books in-house, accurate, and up-to-date.

This is why virtual bookkeeping services in the USA are becoming the choice of progressive companies. Companies using remote professional bookkeepers can save on overhead, increase accuracy, and get real-time financial visibility without a full-time staff.

Virtual bookkeeping is a contemporary financial service that allows companies to remotely handle and run their financial administration process (instead of physically being on location) through cloud-based software, similar to QuickBooks, Xero, or Zoho Books. Instead of employing an in-house accounting team, companies outsource bookkeeping services to a third party that can work outside the business premises, fully available to them on digital and real-time collaboration platforms. This model is cost-effective in its operations and immensely flexible, with much control available.

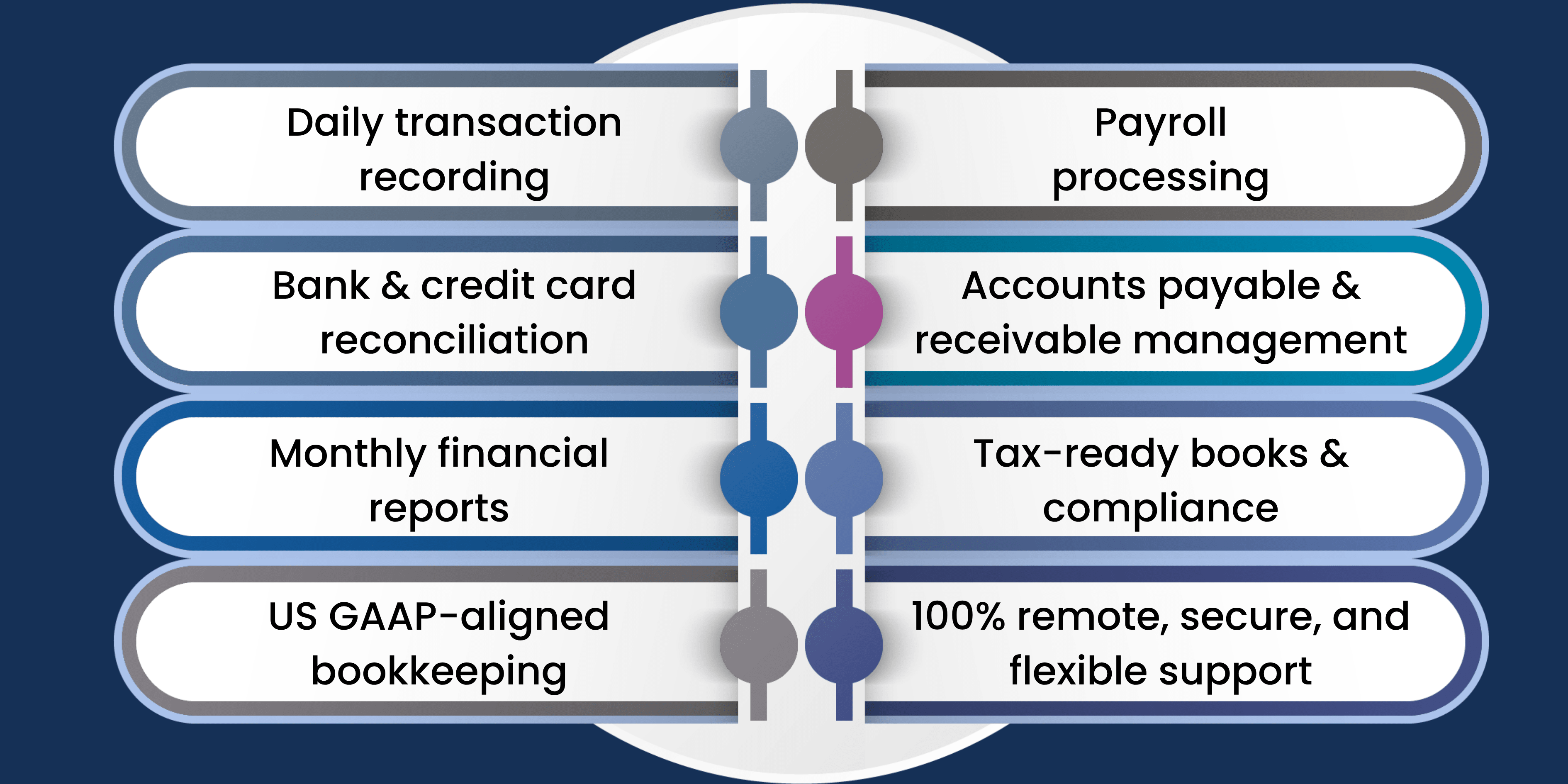

In its essence, virtual bookkeeping addresses all the most important financial tasks that keep your company well-functioning. These usually involve maintaining daily financial operations like sales and purchases, balancing of bank accounts and credit card accounts, account balancing (A/P and A/R), salary remission, and preparing reports that can be used to file taxes. Moreover, when using virtual bookkeepers, profit or loss statements, balance sheets, and cash flow summaries are prepared monthly to let business owners know how sound their business is.

However, out-of-house, virtual bookkeeping provides the same accuracy, consistency, and compliance with superior levels rarely achieved in an in-house team. This is an added advantage because with the lowered overhead, they could channel the resources back into their business without worrying about their finances, as it would still be in the hands of competent personnel.

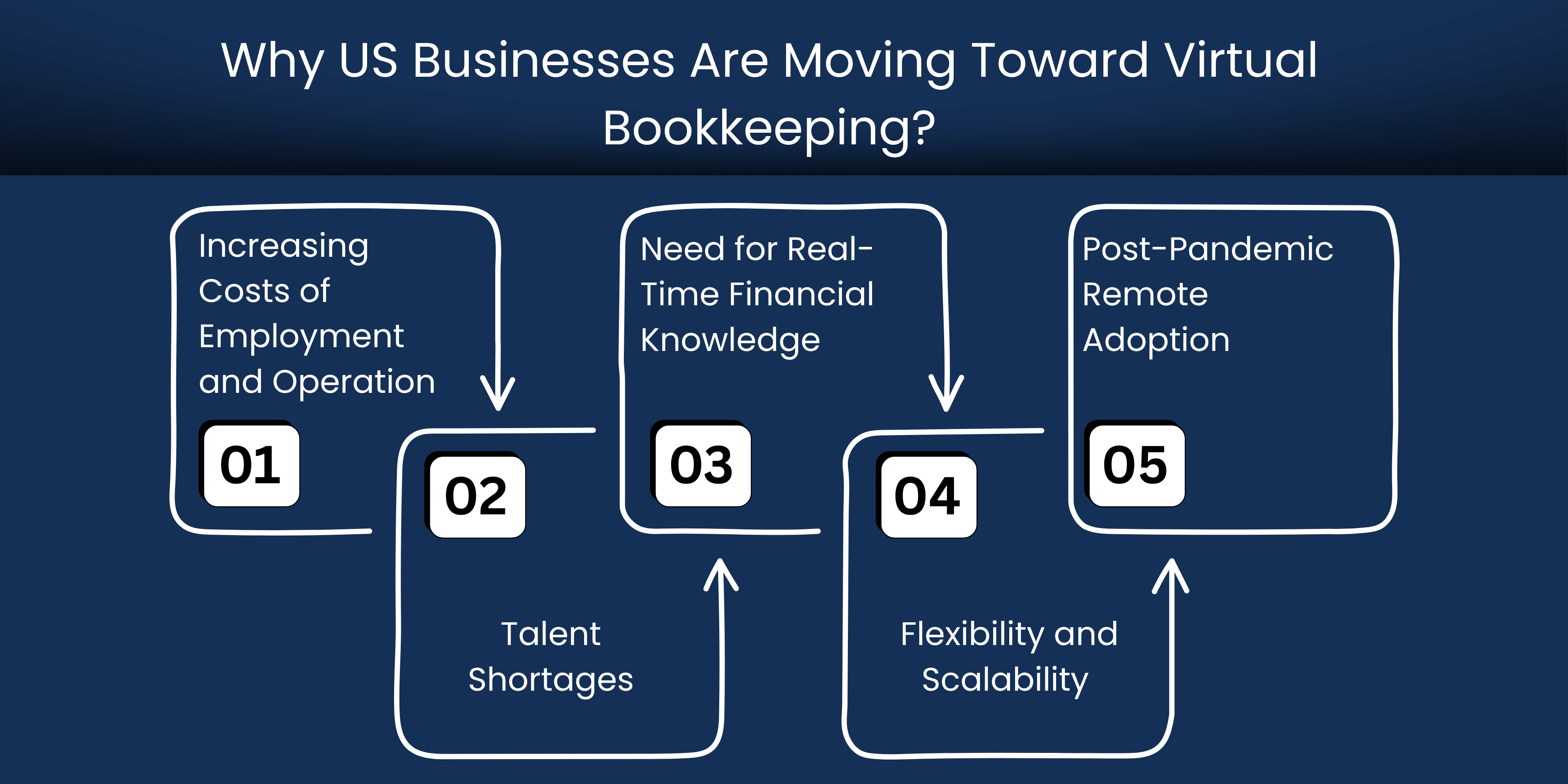

Traditional bookkeeping is being re-examined by numerous businesses in the U.S. because of rising expenses and work dynamics. Virtual bookkeeping provides a more up-to-date, affordable method that offers expert advice with extra flexibility. The leading causes of this change are the following:

Employing an in-house bookkeeper is tricky because it includes the expense of salary, benefits, room, and applications. Virtual bookkeeping removes such overheads, allowing companies to save more.

Small businesses have difficulties in finding competent bookkeepers locally. Virtual services also provide access to trained people with expertise in the U.S regulations.

With cloud-based bookkeeping, business owners get instant access to up-to-date financial data. This makes making smarter decisions easier, keeping a close eye on cash flow, and staying on top of reporting without delays.

COVID-19 helped normalize remote work across the board. Today, many businesses feel confident trusting virtual teams with important tasks like bookkeeping, knowing the work will be done securely and efficiently, even from a distance.

Virtual services are flexible to business requirements. You can increase or decrease according to the needs of part-time or full-time staff without waiting time.

The size range of businesses and industries does not restrict virtual bookkeeping. It is not tied down to a specific setting, nature of business, or size; thus, it can be used to power anything from a high-volume eCommerce store to an individual company user.

The following are some business types that gain significant advantages from using the virtual bookkeeping service:

eCommerce enterprises have more than one channel of sales, complicated inventory management, and sales that occur daily; hence, effective bookkeeping is an essential ingredient in maintaining profitability.

Whether it is insurance billing or vendor invoices, healthcare practices have special accounting requirements. A virtual bookkeeper will enable cash flow, billing patients, and compliance with regulations without overwhelming the medical personnel.

Agents and firms manage huge transactions, rental income, and client monthly payments. Their requirements are facilitated by virtual bookkeeping using the effective monitoring of commissions, payment of mortgages, and expenses concerning property.

The volume of transactions might be low for independent professionals, but regular monitoring of income and business costs and collecting payments from clients are still required. The idea behind virtual bookkeeping is perfect for enjoying clean books and getting ready during the tax season without paying a full-time employee.

In-house teams are easily overwhelmed with daily sales, payments to suppliers, payroll, and preparing taxes. A virtual bookkeeper helps to make entries in time, in the right categories, and according to the local and federal tax laws.

Donor tracking, grant reporting, and strict compliance allow nonprofits to have virtual bookkeepers with expertise on the types of financial statements needed for 501(c)(3) organizations.

Briefly, every business that wants to eliminate manual work and better control its financial situation can gain profit by deploying virtual bookkeeping services to their organization, regardless of size or business sector involved.

Bookkeeping is way beyond data entry. In the background, trained staff deal with all aspects of organizing, managing, and securing all your financial records. Their role is to ensure your books are correct, conform to the law, and are never outdated. This is what professional virtual bookkeepers can do to take care of your business:

Bookkeepers record all your day-to-day business activities—like sales, purchases, expenses, and deposits. This keeps your financial records well-organized and always up to date.

Experts review your bank and credit card statements and match them with the transactions in your books, making sure everything adds up and not a single dollar goes untracked.

Virtual bookkeeping tracks the vendor invoices, payments, and customer balances to ensure a good cash flow and fewer out-of-time collections.

Virtual bookkeepers will also use their payroll services to calculate the wages and salaries accurately, calculate continuously, manage tax withholding and benefits, and so forth. They will also ensure that payroll tax is filed with the appropriate authorities and that you do not get into trouble with the employment laws.

They produce the proper monthly statements, such as P&L statements, balance sheets, and cash flow summaries, which are necessary for making decisions and investor relations.

Your books of accounts are maintained in a tax-ready status. This will make it easy to do end-of-year financial reporting and reduce the risk of an audit or an IRS review.

With the help of encrypted channels and file-sharing applications, professionals store and exchange sensitive financial data so that your business information remains safe and confidential.

Most virtual bookkeeping professionals do more than basic bookkeeping by emphasizing trends in the cash flow, pointing out mistakes or inefficiencies, and providing valuable suggestions when needed.

The virtual bookkeeping specialists offer complete management of your finances, leaving you with clean books, a clear mind, and assurance that your bank accounts are in the hands of trained professionals.

The convenience of outsourcing bookkeeping in a virtual team is not the only advantage that such a decision can offer to modern companies; there is also a potent mixture of cost savings, higher expertise, and flexibility that a virtual team can offer. These are the best advantages that companies in the US will encounter when they convert to a virtual bookkeeping system:

Farewell to high wages, recruitment costs, office premises, and bookkeeping programs license keys. The fixed costs are significantly reduced by virtual bookkeeping, meaning that those big chunks of capital can go to other priority areas.

Professional Accuracy

Your professionals will be the qualified workers who know the U.S. accounting standards (GAAP) and the IRS regulations, as well as the requirements to be complied with. Your records would thus be accurate and error-free.

You can access your financial dashboard anytime, anywhere, with cloud-based platforms. Create better decisions using current reports and cash flow monitoring.

When automated and reviewed by the expert user, the possibility that the entry is duplicated, some expense was not reimbursed, or the incorrect reconciliation was made drops astronomically.

Outsourcing the bookkeeping process allows you and your staff to work on expansion, planning, and customer care rather than losing time chasing receipts and balancing spreadsheets.

Decide what is most advantageous to your business, including part-time services, full-time services, or plans by project. Virtual services are very flexible and can adjust to changes in your requirements.

Your virtual bookkeeping team can grow with you. As your business expands, they can provide additional resources within your company and meet your needs without increasing office space or the number of people employed within the industry.

Remain up-to-date with tax deadlines, payroll, and regulatory requirements. Audits and tax seasons are also stress-free when books are well-maintained.

Example Scenario:

A part-time execution of virtual bookkeeping is utilized in a retail store with seasonal highs throughout the significant part of the year. They ramp up during the holiday and payroll-managing season, ensuring they can handle more transactions without hiring more employees. The result? Improved financial management, reduced operations, and lowered costs all year round.

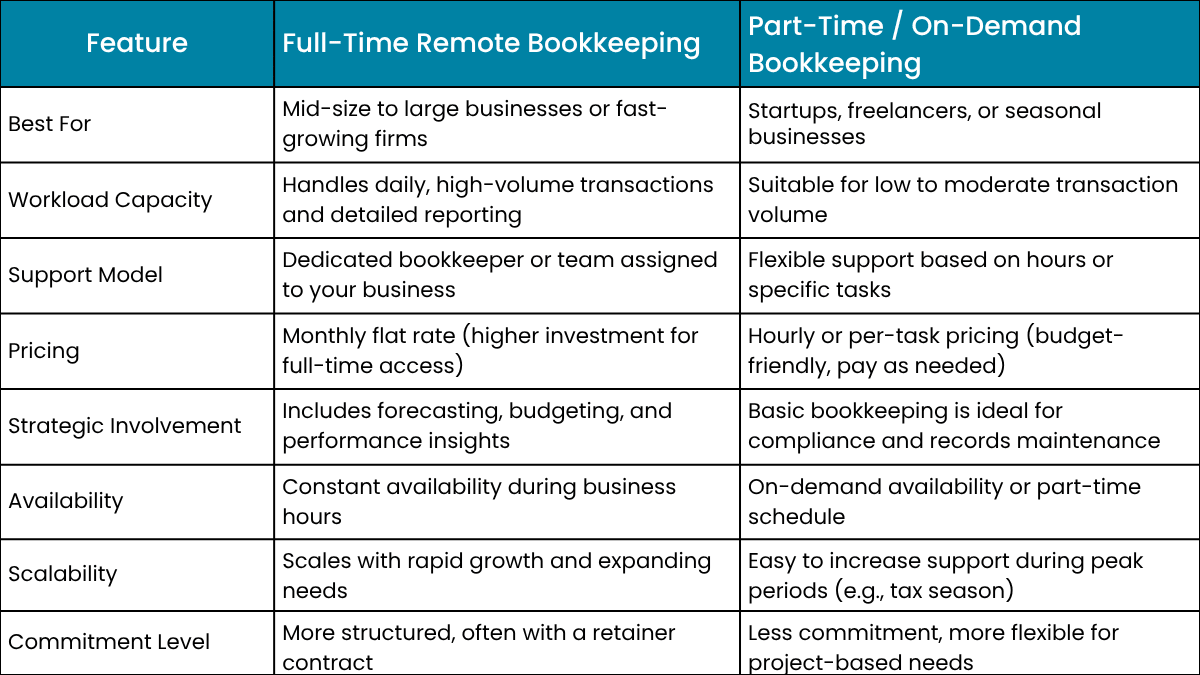

The appropriate virtual bookkeeping model selection is based on the size, the number of transactions, and the complexity of your finances. And this is a small comparison that can help you choose what is most appropriate:

Thanks to remote bookkeeping services in the U.S., startup companies can get basic accounting services cheaply. In contrast, growing businesses can also accommodate a scalable, cloud-based bookkeeping solution that saves money. This blog explains virtual bookkeeping, who it would better serve, and whether converting to this new method of doing books will likely be one of the wisest financial decisions businesses will ever make.

The breakdown will make sure you end up with a model of the service that is in line with your business objectives, costs, and financial intricacy.

In the case of virtual bookkeeping, experience, accuracy, and trust do count. As a partner of choice for U.S. businesses seeking cost-effective, professional, and secure bookkeeping services that meet American accounting standards, Aone Outsourcing offers bookkeeping services to U.S businesses.

Knowledge of the US Standards: We have a U.S.-trained staff, covering all aspects of U.S. bookkeeping, such as the GAAP, IRS tax laws, and government compliance.

Certified Professionals: Your experienced bookkeepers and accounting experts are also versed in the peculiarities of the U.S. financial reporting.

Seamless Onboarding: We provide a seamless onboarding process, ranging from creating a successful integration of software to meeting your business needs.

Cloud Compatibility: We integrate with applications you already use, such as QuickBooks, Xero, Zoho Books, etc., to be consistent and have real-time availability.

Data Confidentiality: Being highly encrypted and secure, your confidential financial information is safely kept and entirely in line with the privacy laws of the United States.

Flexible Pricing & Support: Whether you want an hourly, monthly, or project-based package, it all depends on the business cycle and budget.

Trusted by US Businesses: Being a start-up to an established service provider, we have assisted over 100 clients in the United States over the past few years in streamlining their books, accurately and reliably.

Final Thought!

Virtual bookkeeping is not just a convenient new trend, but a strategic decision that United States companies can make to reduce costs, remain compliant, and pursue the services of highly-qualified professionals without incurring the expense of hiring and maintaining internal personnel. As a small startup or an organization in the industry, virtual bookkeeping can be your advantage in that it is flexible, accurate, and affordable.

At Aone Outsourcing, we ensure the transition to being virtual is effortless and fruitful. Our team of qualified personnel, robust systems, and excellent knowledge about the U.S. accounting requirements ensure that we can keep your business financially sound.

Have our professionals care for your books as you concentrate on your business. Aone Outsourcing offers a free consultation on how we can help you save costs and have better financial visibility.

An average virtual bookkeeper is paid between 20 and 60 an hour in the U.S., depending on how experienced and certified they are and the nature of their services. There are high-end welders for those with niche industry knowledge or Indians in senior and related professional occupations who can charge more, provided they provide tax or advisory services.

Indeed, the demand for virtual bookkeepers is increasing in the U.S. With the increased use of remote work and cloud-based accounting solutions in small companies, the demand for flexible and affordable solutions that support the bookkeeping processes increases steadily, as well, particularly in such industries as e-commerce, healthcare, and real estate.

Absolutely. Remote bookkeeping has been very much in demand because of its capacity to help save some costs whilst still delivering quality and compliance bookkeeping. Small to large business enterprises now find it more convenient to outsource bookkeeping to specialists who can work effectively without the burden of absorbed costs of an in-house position.

Q4. What is the best online bookkeeping system?

Some of the best internet-based accounting systems that are commonly used by businesses in the U.S. include:

Your online accounting services supplier, such as Aone Outsourcing, will assist you in choosing and controlling the most effective system according to your field and reporting requirements.