GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

In 2025, small business bookkeeping will become crucial and is a key factor in the success of your business. Due to changes in financial regulations, the increasing number of employees working from home, and the pressure to be prepared for audits, bookkeeping now requires more than just keeping financial records. Now, logistics needs careful management, attention to detail, and the use of modern technology.

Cloud-based technology and automation make it possible for every business to use reliable bookkeeping services that used to be available only to large companies. Because of digital tools, tracking finances is now easier, and useful information is available instantly for great decision-making.

You will learn the key aspects of small business bookkeeping in this guide made for newcomers. If you learn the fundamentals and pick the correct methods, use new technology, and know when to delegate, you will easily manage your finances in 2025.

Best bookkeeping for small business means recording, arranging, and managing a company’s financial activities. It guarantees that every transaction in and out of your business is properly tracked and recorded.

Income generated by selling products or services.

Rent, utilities, and the necessary supplies.

Salaries and benefits are giv

en to the workforce.

Taxes such as value-added tax, income tax, and sales tax.

Entrepreneurs and owners of small businesses depend greatly on reliable bookkeeping. It facilitates tracking of money, taxes, obtaining loans, and good decision-making in a company. If there is no budgeting, the chances of facing penalties, overspending, and missing out on opportunities may increase.

To find the best bookkeeping for small business, pick a system that is easy, accurate, and suited to your requirements, either by software, professional, or outsourcing. It is important to have good bookkeeping habits for compliance as well as for the future of the business.

Because things develop rapidly in today’s world, reliable bookkeeping isn’t something nice to have but something your business needs. There are even more reasons why this anniversary will matter in the year 2025:

Following timely bookkeeping practices allows you to see all your money coming in and going out, which helps you manage your money well. Therefore, small businesses can avoid difficulties and look forward with certainty.

Since taxes are becoming more complicated and rules are getting stricter, keeping things organized protects you from mistakes and sudden problems. When you keep your bookkeeping up to date, your business meets its deadlines easily.

Precise financial numbers enable you to calculate your likely income, arrange your expenses, and notice common trends. This allows businesses to handle their finances more wisely and plan for any possible changes in today’s economy.

Books are helpful when deciding on new investments and also for handling business every day, since reliable numbers from books reflect your real financial condition.

People and companies involved in financial matters want proper financial statements. Professional bookkeeping services help your company present records that build its reputation and make lenders more willing to give it funds.

Because of the latest laws on data privacy, tax reporting, and digital invoicing, you stay compliant and prevent penalties thanks to good and updated records.

In the future, keeping trust, expanding ability, and staying stable are more important than only balancing books.

Selecting a good bookkeeping method helps small businesses achieve success. We should look at the most common types of systems and the types of businesses that fit them.

Each transaction is recorded with only one entry, regardless of whether it is income or an expense.

It acts like a chequebook, being straightforward but not very versatile.

This option is good for sole proprietors and businesses with low activity.

All transactions are noted in both the debit and credit sections of the books.

Makes it possible to record assets, liabilities, and equity accurately.

Preferred when your business is bigger and calls for formal financial statements.

Most small businesses use single-entry bookkeeping first and change to double-entry once their activities or requirements from the law increase.

Revenue and expenses are entered into the accounts when money is either received or given.

Convenient to manage and perfect for small service companies or single self-employed individuals.

Whenever income or expenses are recorded, they should be listed immediately.

Shows the real financial status, which is typically required when seeking the support of investors or lenders.

Accrual accounting, together with double-entry bookkeeping, is considered the best bookkeeping for small businesses since it helps a company manage its finances transparently and for the long term.

If your business consists of you being the sole person, try single-entry with cash accounting.

If there is an inventory to manage or employees involved, you should practice double-entry + accrual accounting.

When you wish to raise money or grow rapidly, ensure you have professional assistance with bookkeeping.

The right bookkeeping for a small business ensures you are following the rules and also optimising your finances for your business and aims.

Currently, bookkeeping is being changed by advanced technological systems and AI. Such technological changes mean that keeping track of finances is now easier and more accurate for small businesses.

Popular Digital Tools & Cloud Solutions

Many people use QuickBooks Online, Xero, Zoho Books, and FreshBooks as prominent cloud-based systems.

Using these, small business owners can take care of invoices, payroll, expenses, and reports from wherever they are, any time needed.

Commonly, such platforms provide users with mobile apps, bank feeds, and cloud storage that protects their data.

Thanks to smart automation, you do not have to type in data as it collects this data from your bank accounts, scans your expenses, and organises them for you.

With AI, small deviations can be spotted, categories may be reliably suggested, and useful reports can be generated.

With time, machine learning tools get familiar with your habits and make recurring tasks easier and more precise.

Being online means cloud bookkeeping keeps data current, which makes it convenient for both travellers and people working in remote offices.

Automation cuts down the chances of people committing errors and filling in duplicate data.

Because your data is automatically saved securely, you do not have to worry about losing important documents.

To sum up, using technology in 2025 makes bookkeeping dependable, swift, and adaptable to the future.

The decision between handling your bookkeeping or hiring someone to do it for you is based on your knowledge, how much time you can spare, and the complexity of your business. I have broken down the comparison to make sure you have all the information:

There are not many transactions for your business, and you can handle basic bookkeeping.

You need to keep operational costs low since you are just getting started.

You are good at managing your cash and also have the time to maintain order

Your company is expanding fast with the addition of new employees.

You are falling behind on important dates, finding taxes hard, or making several mistakes.

Professional financial reports are important when making decisions about investors or the company’s strategy.

You are looking to build the business, not get bogged down in handling the numbers.

Resort to outsourcing bookkeeping if the time and effort needed to do it yourself are no longer worth what you get out of it. When you use professional bookkeeping services, you maintain compliance, stay financially fit, and are ready to expand.

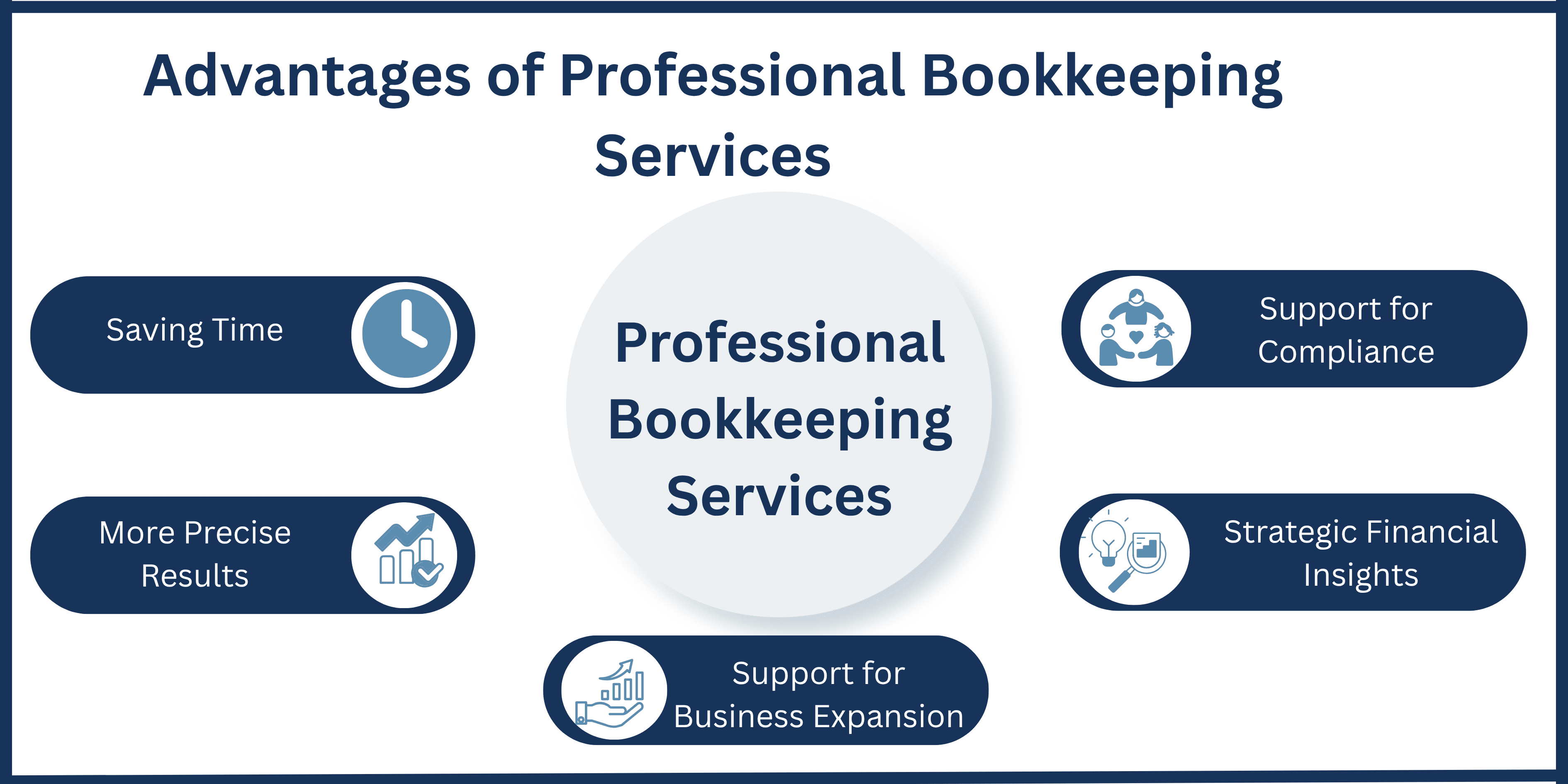

With the business world always on the move and facing strict rules, hiring professional accountants is not only practical but also a solid strategy.

Saving Time: The process of bookkeeping can be very time-consuming. Outsource bookkeeping lets you recover time to improve your business, interact with customers, or develop new items. It’s possible to let experts handle the receipts, spreadsheet,s and reconciliation reports since you don’t do them yourself.

More Precise Results: By using the latest tools and accounting software, expert professionals manage to ensure that all records are handled well and without mistakes. It minimizes the chance of errors that could bring about financial statement mishaps or penalty fines.

Support for Compliance: Because tax laws and financial reporting standards are updated every year, keeping up with them is not easy. Professional bookkeepers follow the rules and deadlines set by the IRS to help your business stay lawful throughout the year.

Strategic Financial Insights: An excellent bookkeeping partner goes beyond data and offers useful information. Every month, you receive reports on your revenue and expenses, predictions for cash flow, and other useful information. Because of this mental accounting, you can organize your finances better and decide with facts.

Support for Business Expansion: When your business expands, the financial side becomes more complicated. These services change with your business, providing payroll help and managing the finances and taxes for various companies at the same time.

If you’re starting alone or building a large company, having bookkeeping done by professionals helps you maintain transparency, hold onto control, and promote growth.

A lot of small businesses in today’s technology era still make unnecessary errors when handling their finances. In recent years, these risky mistakes have been some of the biggest issues, but here’s how to avoid them:

Linking personal and business activities during tax season leads to uncertainty and makes it challenging to see how profitable the business is.

Make sure to create a business bank account and keep every expense sorted by category.

If you do not keep track of your bank statements with your books, you might miss some errors or fraud.

It’s important to reconcile your accounts monthly, and the automated processes or a bookkeeper will help with that.

Failing to track receivables may result in serious problems getting paid.

Use systems that can remind clients to pay and that list when invoices become overdue.

Try using internet-based accounting systems that safely keep your data and let you access it whenever needed.

Making sure you don’t make these errors will allow you to keep track of your finances and support your expansion.

Bookkeeping is important for finances and also serves as the base for growing a successful company. Given that remote work, digital transformation, and updated rules are influencing businesses in 2025, having a solid system is now more important than it ever was.

When you have solid bookkeeping as a small business, you can easily handle money, get ready for taxes, and make key decisions. If you are beginning or already expanding, top-notch bookkeeping can give your business an edge over others.

Managing your finances can be tough; it might not be a bad idea to hire a trustworthy team of bookkeepers. Getting help ensures you have no issues on your record and peace of mind.

At Aone Outsourcing, we take care of bookkeeping to allow your business to grow with confidence. Feel the difference with the help of our support experts. Let our team do your bookkeeping in 2025 and receive great, accurate, and trouble-free services.

To manage bookkeeping for a small business, first arrange your records of revenue and expenses, pick a single or double-entry method, and make use of accounting software or spreadsheets to observe all the transactions. Companies may decide to give bookkeeping tasks to professionals to avoid errors and stay in line withthe rules.

2. What kind of bookkeeping is used by small businesses?

How complex and big a company is tends to guide whether it will use single-entry or double-entry bookkeeping. If a business is growing, it is advised to use double-entry, but simple businesses can start with single-entry. Companies regularly use cash or accrual accounting practices.

The prices for bookkeeping can change based on the company’s size, the number of transaction,s and whether the service is performed in-house or by outsiders. Most companies spend between $200 and $1,000 for outsourced bookkeeping each month. Professional bookkeepers may adjust the cost of their services to your company’s specific needs.

Five main principles form the basis of bookkeeping.

Revenue Recognition: List as revenue the money you have earned.

Recognize Expense: Make sure expenses are linked to the related revenue.

Consistency: Use the same approach to accounting whenever you need to.

Going Concern: The company is expected to keep operating.

Accrual Principle: Report your company’s revenues and expenses when they are earned or owed, not when money comes in or out