GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Managing payroll used to be a simple task, calculating hours, deducting taxes, and paying employees on time. But these days, it’s not that simple. With growing teams, evolving tax laws, remote workforces, and stricter compliance standards, payroll has become one of the most complex administrative functions in a business. For many owners, finance managers, and accounting firms, it's also one of the most time-consuming. A single error in payroll can cost you not only in penalties but also in employee trust and operational downtime.

When your employees have missed a pay cycle, been unable to keep track of their entitlements or have lost time chasing software problems or paying off payroll audits, you are not alone. Most enterprises start with an in-house payroll, thinking that it gives them better control. However, when the business expands or the complexity increases, it is evident that internal systems are normally strained to the limit. On the other hand, outsourcing payroll might be an effective idea; however, concerns arise regarding data security, flexibility, and potential miscommunication.

This is where the argument of in-house payroll Vs outsourcing comes into effect. It is not really about cost, but it is about what is viable, scalable and secure to your exact business requirements. We will explore this blog, detailing the advantages of outsourcing or opting for an in-house payroll, understanding the limitations of using an in-house payroll, and making a confident decision about the model that suits your intentions in 2025 and beyond.

In-house payroll implies that your business handles the entire payroll practice on your own with your handhelds and employees. It is your team's responsibility to gather time data, compute wages and taxes, administer benefits, file statutory returns, and ensure compliance with employment and tax regulations.

Such an arrangement is popular with companies that desire to have complete control, whose teams are stable, and are able to sustain software systems and staff training. This might be effective in the initial phases of an organisation, but soon it proves to be an overhead when teams expand, the needs of the employees change or the compliance implications of the organisation change.

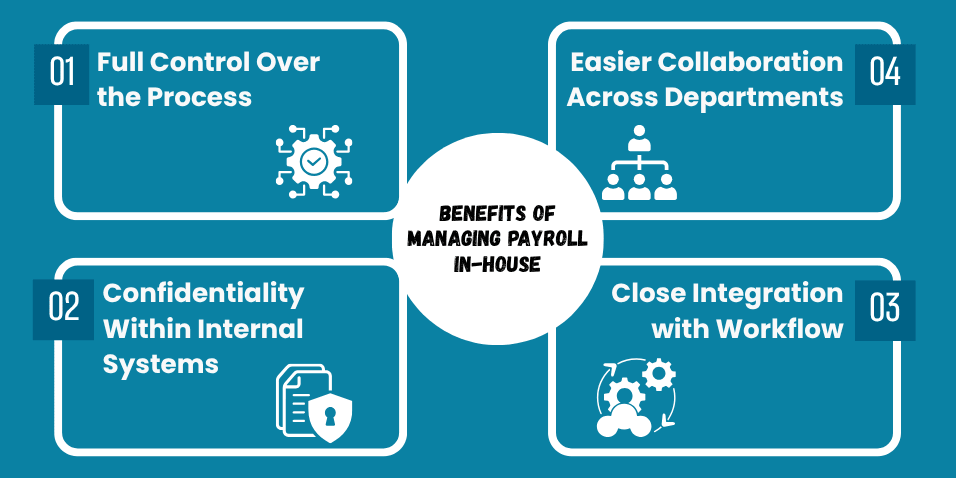

In-house payroll gives you direct oversight over every step, from data collection to pay runs and tax submissions. This can be beneficial if your payroll processes are unique or require custom logic, such as multi-level approvals or industry-specific bonus structures. Having control also allows for immediate changes, whether it's correcting a last-minute error or adjusting a termination payout.

Some companies prefer to ensure that all their sensitive internal remuneration and staff information remains confidential. When your company deals only with executive compensation plans, founder equity, or executive bonuses, where you already have an in-house investment in secure systems and internal rights controls, then it can be a solution to keep this data within the company.

Since your team understands your organisational structure, payroll processing can be more aligned with internal HR policies, team changes, and company events. For example, payroll can be synced more easily with promotions, anniversaries, and time-off approvals, eliminating the need for back-and-forth communication with a vendor.

When payroll is managed internally, HR, finance, and leadership can quickly communicate and make decisions. If there’s a policy change, tax query, or benefits adjustment, your team is already familiar with your internal processes and can implement changes faster.

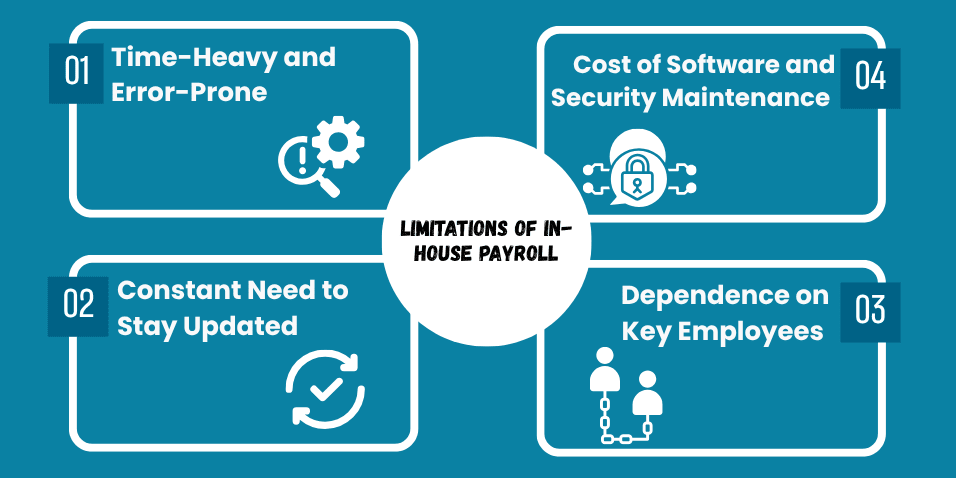

Payroll involves more than just clicking ‘send’ every two weeks. It’s calculating varying wage types, managing paid/unpaid leave, applying tax rates correctly, updating employee files, and tracking deadlines. For companies with multiple departments or hourly workers, this task becomes manual and error-prone, consuming valuable team hours.

Tax thresholds change. Leave entitlements are updated. Superannuation and pension contributions vary by age, industry, and jurisdiction. Your internal team needs to stay constantly updated, or risk non-compliance. For small businesses, this is one of the biggest risks of keeping payroll in-house.

In-house payroll software isn’t a one-time cost; it requires ongoing license fees, training, updates, and IT support. Plus, you must ensure data is stored securely and backed up regularly. Without these, your business could be vulnerable to payroll fraud, data loss, or software breakdowns at the worst possible moment.

What happens if your only payroll expert takes leave or resigns? Payroll is a continuity-sensitive function. Any disruption due to internal staffing issues can delay payments, cause errors, or force you into reactive firefighting mode just to meet basic deadlines.

Outsourced payroll means the engagement of an outside payroll service specialist to help you with all or part of your payroll processes. Such vendors usually employ the best and latest cloud-based systems and even in this case, the personnel would be payroll experts who understand the details of regulatory compliance. Their role is to ensure that your employees receive the correct payment on time, while also handling tax deductions, benefits, reporting, and regulatory filings. You supply the nuts and bolts of the employee data, and they do the rest, which is often quicker and more accurate than internal units.

Payroll outsourcing is no longer a trend; it has become a strategic initiative for companies that need to simplify their operations, minimise compliance liabilities, and focus on driving business growth. Regardless of whether you have a growing startup, hectic accounting firm or an already established company growing across continents, here are the benefits of payroll outsourcingyou need to consider:

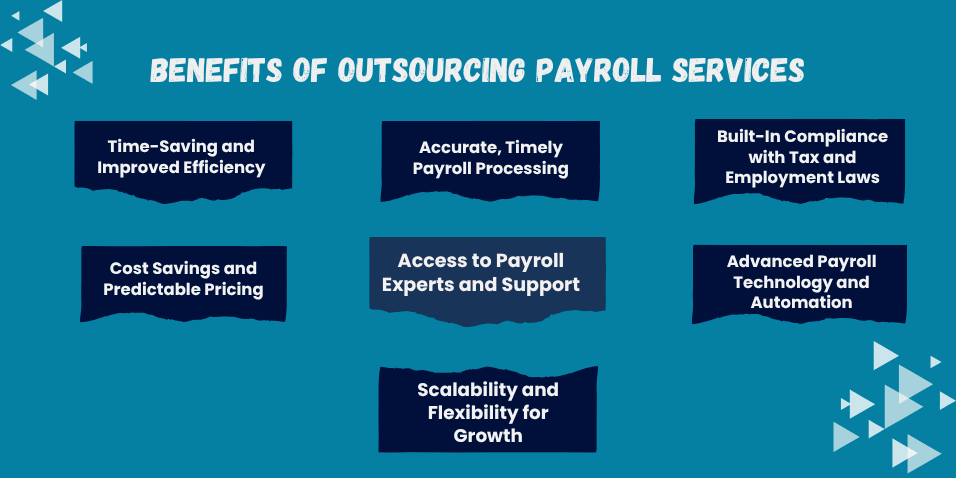

One of the most immediate and noticeable benefits of outsourcing payroll give you time to focus on your internal team. Payroll processing is repetitive, deadline-driven, and detailed work that can easily consume hours each week, especially if you're handling multiple pay rates, overtime, leave balances, deductions, and compliance submissions. With an outsourced payroll provider, all those admin-heavy tasks are taken off your plate.

This allows your HR and finance teams to focus on higher-value strategic work like budgeting, workforce planning, and business growth. And because the provider uses automated systems, processing is faster and far more accurate than manual, in-house methods.

Mistakes that occur in payroll, such as incorrect hour calculations, tax oversights, and late payment issuance to employees, can erode trust between employees and compliance. Among the key payoffs of outsourcing payroll, an increased level of accuracy and timeliness is to be noted.

Payroll service providers have checks and balances that run on sophisticated systems. They handle hundreds of pay runs per month, so their processes have been developed to be precise. This implies that employees will be compensated at the right time, at the right amount and without deadlines and last-minute desperate corrections.

The ever-changing tax and payroll laws may include new tax codes, pay changes, pensions auto-enrolment, superannuation levels and holiday pay. When payroll is done internally, you are the one that has the responsibility of keeping track of all these updates. Outsourcing payroll hands the compliance issue to your service provider.

They are qualified professionals who also have their eyes on the local and international updates on regulations, and they also ensure that they do adjust the payrolls accordingly. This minimises your chances of being fined, audited or having disputes with your employees and being at the wrong side of the law.

Many companies believe that processing payroll internally is less expensive, but this is frequently not the case when you account for software licenses, employee training, compliance expenses, error penalties, and lost time due to manual processing. Typically, outsourced payroll is provided at a fixed rate per employee or per pay run, which facilitates budgeting. Additionally, you can avoid paying more for tax updates, backups, and reporting features, or investing in pricey payroll systems. Payroll outsourcing is frequently far less expensive for small and mid-sized businesses than keeping a full staff on staff.

By outsourcing payroll what you are doing is not purchasing a service; you are hiring hundreds of people who breathe and live payroll. These experts also have a great knowledge on the local tax system, cross-border employee compensation, industry-based entitlement and payroll best practices. They can answer your questions, solve problems quickly, and provide recommendations on complex payroll conditions. Keeping them at this level of skill may be a problem internally, especially in small firms or where there is not HR or finance department.

Most outsourced payroll services come with cloud-based platforms that include employee self-service portals, direct deposit, automated tax submissions, leave tracking, and real-time reporting. You don’t have to maintain or update this software—it’s all included in the service.

These platforms also integrate with your existing accounting and HR systems, reducing duplicate data entry and human error. This level of automation and technology gives your business a professional-grade payroll system without the associated infrastructure costs.

Outsourcing payroll makes it easier to grow. Whether you're hiring five people this month or expanding into a new country, your provider can scale up or down with you. You don't have to worry about hiring new payroll staff, upgrading software, or adjusting to new compliance rules on your own. For seasonal businesses with fluctuating staffing levels, outsourced payroll offers the flexibility to match your needs, without locking you into fixed internal resources.

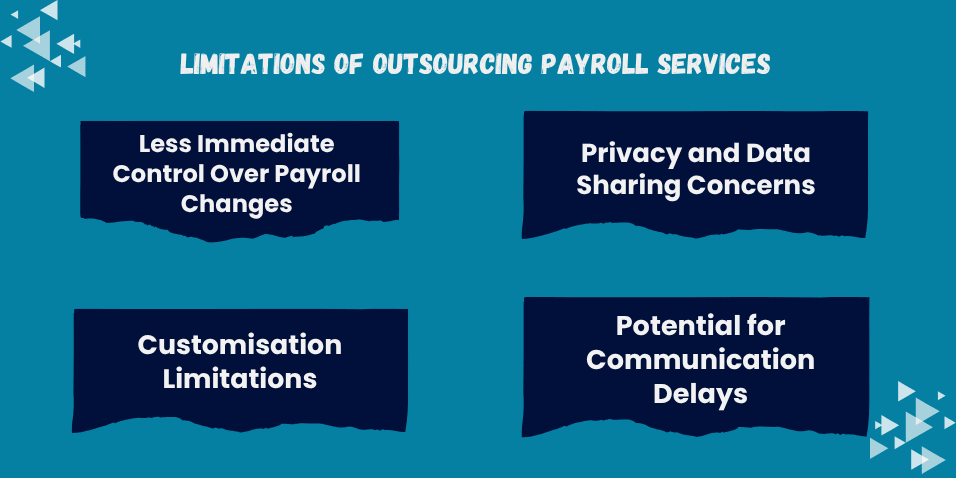

If you need to make last-minute edits to a pay run or correct a mistake immediately, you may need to go through the provider’s process, which may not be instant. Turnaround times vary, and urgent changes may incur additional costs.

Payroll involves sensitive employee information. While most providers have strong security measures, some businesses still feel hesitant about sharing data externally. It’s critical to vet your provider for compliance with data security standards like GDPR or ISO 27001.

Working with an external team means you need clear communication channels and shared timelines. Misunderstandings around pay cycles, holidays, or changes in tax policy could result in delays or errors if not managed well.

4. Customisation Limitations

Some payroll providers offer standardised services. If your business has complex payroll needs—like job costing, split shifts, variable bonuses, or specific industry award interpretations—you must ensure the provider can accommodate those complexities before signing the contract.

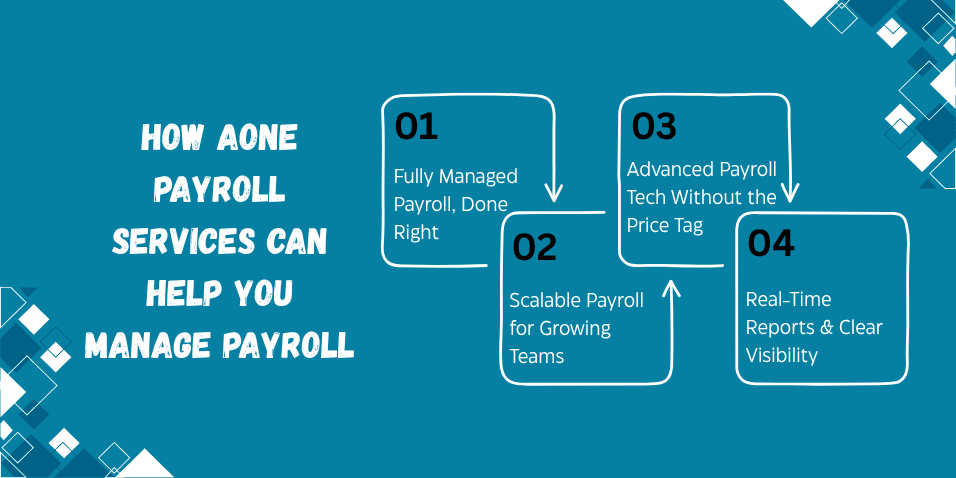

At Aone, we take payroll completely off your plate—from employee onboarding and pay runs to tax filings and year-end reports. No more last-minute errors, missed deadlines, or compliance stress. We run payroll accurately, on time, every time—so you can focus on running your business.

Our team of payroll specialists keeps up with the latest tax rules, pension/super changes, and labour laws in your region. Whether you're in the United States — we ensure your payroll is 100% compliant with local legislation. That means no penalties, no audits, and no sleepless nights.

Whether you’re paying 5 people or 500, our solutions grow with you. We work with SMEs, enterprises, and accounting firms that need reliable and flexible outsourced payroll services. New hires? Promotions? Multiple locations? No problem—we scale with your business seamlessly.

Why invest in expensive payroll software when you can access powerful cloud-based payroll platforms through us? Aone offers modern automation, employee portals, digital payslips, direct deposit, and integrated compliance features—all included with our services, no extra licenses required.

Want to track payroll costs, view tax filings, or analyse overtime spend? Aone’s payroll services come with on-demand reporting dashboards that give you full visibility into your payroll data—so you stay in control, even when the processing is outsourced.

The decision to use in-house payroll versus outsourcing payroll services involves more than just convenience; it becomes a strategic choice that can significantly impact your time commitment, costs, compliance, data protection, and overall business management. The in-house payroll can provide you with a certain level of control and alignment with internal processes, yet it will require high time and resource consumption, as well as administrative management of compliance.

Outsourced payroll, on the other hand, provides expert assistance, automation, inbuilt compliance, cost reductions and scalability to modern businesses. Whether you are a small to middle sized business or an accounting company wanting to reduce administrative burden, or an organisation operating in more than one region or country, the advantages of outsourcing payroll outweigh the constraints. It is not a matter of delegating a job, but rather of obtaining a partner who assists you in doing better payroll smarter, safer, and faster.

Ultimately, the solution that allows you to simply pay attention to what you know best, and that is expanding your business, and payroll occurs without you really thinking about it in the background is the best solution.

Time savings, cost savings, increased accuracy, real-time reporting, expert support, scalable services, and strict adherence to labour and tax regulations are some of the main advantages of outsourcing payroll.

Some possible downsides are less direct control, delays in communication, and worries about data privacy. But most problems can be avoided by picking a reliable provider with strong service-level agreements (SLAs) and rules for following the law.

Yes. Many payroll providers offer flexible packages tailored to small teams, often at a lower cost than hiring a full-time payroll specialist. You’ll gain access to expert knowledge and modern tools without the overheads of in-house management.

Absolutely. Most outsourced payroll services come with cloud-based dashboards where you can generate reports, track pay runs, access employee records, and monitor compliance—all in real-time.