GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Every year, as businesses across the United States approach tax season, fiscal year-end, or quarterly closings, a familiar storm begins to brew inside their finance and accounting departments. Controllers brace for long nights. CPA firms scramble to hire short-term staff. Business owners worry about meeting filing deadlines, avoiding penalties, and keeping auditors satisfied.

Accounting work in the USA has never been evenly distributed throughout the year. Instead, it comes in heavy waves: tax deadlines, year-end financial closings, quarterly tax estimates, state nexus filings, and payroll reconciliations, all stacking up into periods of intense activity followed by relative quiet. These surges don’t just create logistical headaches. They expose a much deeper problem in how companies manage finance workloads.

Most businesses and CPA firms in the US simply don’t have enough capacity, skilled staff, or scalable systems to handle these seasonal accounting spikes on their own.

The shortage of qualified accountants, growing complexity in tax regulations, the rise of multi-state compliance, evolving technology demands, and employee burnout are converging into what many industry experts now call a "capacity crisis" for American accounting operations.

This is where outsourced accounting firms like Aone Outsourcing Solutions offer not just an alternative but a strategic lifeline, giving businesses the ability to flexibly expand their team during peak seasons, maintain compliance, and grow sustainably without exhausting internal resources.

For many companies, January to April alone represents 40–60% of their annual accounting workload. CPA firms may process more returns in 90 days than the entire rest of the year combined.

And this pressure keeps rising, particularly for businesses operating in multiple states, those selling online (triggering multi-state sales tax nexus), or companies that receive complex K-1 partnership allocations.

These overlapping deadlines create intense workload peaks that can overwhelm even well-staffed finance teams. Accounting work in the US is heavily deadline-driven. Each year brings multiple overlapping obligations:

Federal income tax returns (Forms 1040, 1065, 1120, 1120S)

State tax returns across multiple jurisdictions

Quarterly estimated tax payments

W-2, 1099, and ACA filings in January

Annual sales tax reconciliations

Payroll year-end closings

Year-end financial statement preparation

Audit preparation and schedules

2. Skilled Shortage of Accounting Talent

The biggest underlying crisis? The shortage of skilled accounting talent hits especially hard during peak seasons when every firm and company tries to hire extra help.

For companies that manage accounting in-house, this leaves their existing staff hopelessly overloaded when seasonal surges hit. For CPA firms, it means turning away business or risking service quality because they can’t onboard staff fast enough.

The number of US accounting graduates has been declining steadily.

More than 50,000 accountants left the workforce between 2019 and 2023.

Older CPAs are retiring, while fewer young professionals are entering the field.

Many CPA firms report that open positions remain unfilled for 6–12 months.

Many companies and firms attempt to hire temporary or seasonal staff to survive busy seasons. On paper, this seems like a solution. In practice, it often makes things worse:

Recruitment agencies charge 20–30% placement fees.

It takes weeks to recruit, onboard, and train temp staff.

Temporary workers may not have specialized knowledge (e.g., IRS, state tax, GAAP, industry-specific rules).

Turnover is high, and many seasonal workers leave after just weeks.

Mistakes made by inexperienced temps can lead to costly penalties or audit issues later.

When the stakes are high (as they are with IRS filings, state tax compliance, or financial audits), companies need more than just warm bodies. They need trained, experienced professionals.

When businesses can’t hire enough seasonal help, they do what’s easiest: pile more work onto existing staff. This leads to extreme overtime hours, exhausted employees during tax seasons, missed vacations and family time, higher error rates as fatigue sets in, dissatisfaction, and eventual turnover. The accounting burnout problem has reached crisis levels in the US.

Many companies have watched valued finance team members quit after one or two punishing tax seasons, leaving an even bigger staffing hole next year.

Mistakes during high-pressure periods aren’t just unfortunate; they are dangerous:

IRS late filing penalties can cost hundreds per return.

Sales tax mistakes can trigger expensive state audits.

Payroll reporting errors can result in IRS or DOL investigations.

Improper reconciliations can lead to audit adjustments that cost thousands.

Quality control slips and compliance risk skyrocket when overworked teams rush to meet deadlines.

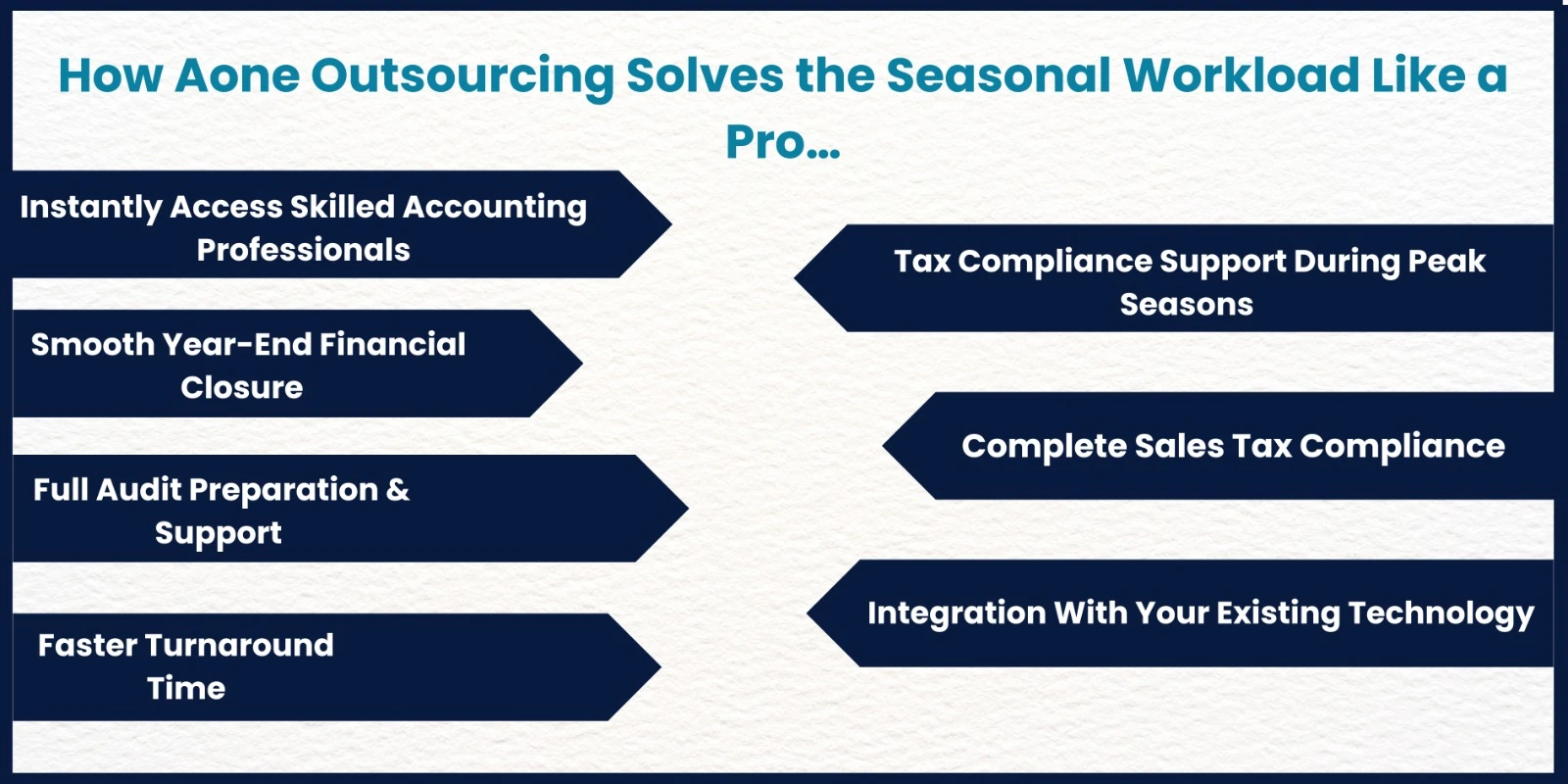

During seasonal spikes, most companies face one overwhelming obstacle: they simply cannot hire skilled accounting professionals fast enough. Traditional recruitment takes weeks or months, only to deliver candidates who still require training on your internal systems, tax processes, or software. That’s where Aone provides a game-changing solution.

Through Aone’s delivery model, US businesses can instantly access fully trained, US-compliant accountants who are ready to handle seasonal volume surges. These professionals come equipped with strong knowledge of US GAAP, IRS regulations, federal and state tax rules, financial reporting standards, and industry-specific nuances.

This flexibility allows CPA firms and businesses to confidently accept more clients, process higher volumes of work, and meet all deadlines during peak seasons, without overburdening their internal teams.

Tax compliance in the US isn’t just about meeting federal IRS deadlines; businesses often face a highly complex web of federal, state, and local filings, each with their own rules, forms, and penalties. Aone’s tax outsourcing services are built to handle this full spectrum of work with precision, accuracy, and speed.

Our trained professionals manage tax return preparation for individuals, partnerships, corporations, trusts, and nonprofits. Whether your business needs assistance with 1040s, 1065s, 1120s, or complex K-1 allocations, Aone ensures every filing is accurate and fully compliant. We also handle multi-state income tax filings, which have become especially challenging as more businesses operate across multiple jurisdictions.

We cover:

K-1 preparation for partnerships and S-corporations

Multi-state income tax filings

Quarterly estimated tax calculations

Franchise tax and state-specific compliance

Year-end informational filings: 1099s, W-2s, ACA

With Aone managing this workload, your internal teams or CPA firm partners can focus on client communication, advisory services, and higher-level strategy instead of drowning in paperwork.

Year-end closing is often one of the most stressful times for finance teams. It’s a period where accuracy is absolutely critical, but deadlines are unforgiving. Small mistakes in reconciliations, journal entries, or revenue recognition can trigger major audit issues later.

Aone takes over many of these time-consuming yet highly sensitive year-end tasks. Our teams perform full reconciliations of bank and credit card accounts, ensure all adjusting journal entries are properly recorded, and prepare complete trial balances for CPA review. We also handle fixed asset reconciliations, calculate depreciation, and monitor deferred revenue accounts to ensure your financial statements reflect the true financial picture of your business.

Bank & credit card reconciliations

Adjusting journal entries

Trial balances and financial statements

Fixed assets & depreciation

Deferred revenue tracking

Support for audit schedules

By outsourcing year-end close with Aone, your internal finance staff stays focused, auditors receive clean, well-prepared schedules, and businesses avoid costly audit adjustments that often arise from rushed year-end work.

Sales tax compliance has become one of the fastest-growing accounting headaches in the US, especially after the Wayfair ruling made multi-state nexus more complex than ever. Many businesses now find themselves filing sales tax returns in 10, 20, or even 30+ states with different rules, deadlines, and calculation methods.

Aone’s dedicated sales tax compliance teams monitor your sales across every state where you have nexus obligations. We ensure timely registration, accurate filings, and proactive compliance to avoid audits and penalties. Our team reconciles collected tax, monitors nexus thresholds, and files returns on your behalf, all while staying fully updated on every state's evolving requirements.

Sales/use tax filings across multiple states

Monthly, quarterly, annual return preparation

Threshold monitoring to avoid late nexus registration

Multi-channel sales reconciliations (Amazon, Shopify, etc.)

Audit defense preparation if needed

With Aone managing your sales tax, your business avoids one of the most common and costly compliance traps facing multi-state and eCommerce operations.

Audits are stressful for any business and even more so when seasonal overload has left financial records in less-than-perfect shape. Aone provides full audit preparation services that ensure your company is fully ready when auditors arrive.

Our teams help prepare all audit schedules, gather supporting documentation, complete PBC (Prepared-By-Client) lists, and assist with variance analysis. Because our workpapers are meticulously prepared, audits proceed more smoothly, with fewer adjustments, faster completion times, and less back-and-forth between auditors and your finance department.

Preparation of audit schedules

Documentation organisation

PBC list completion

Variance analysis and reconciliation support

Continuous auditor collaboration

This proactive audit readiness protects your business from unnecessary audit delays, costly adjustments, or reputational damage.

Businesses rely on a wide range of cloud-based accounting platforms but not every outsourcing firm can truly work inside your existing systems without friction. Aone’s teams are trained and experienced with the most widely used US accounting, tax, ERP, and payroll platforms.

Whether you're using QuickBooks Online, NetSuite, Xero, Sage Intacct, or specialised tax software like UltraTax CS or ProConnect, Aone integrates seamlessly into your workflows. We also handle payroll processing platforms like ADP, Gusto, and Paychex, ensuring that no piece of your finance function is left unsupported.

QuickBooks Online/Desktop

NetSuite ERP

Xero (US edition)

UltraTax CS, Intuit ProConnect, Drake Tax

Sage Intacct

ADP, Gusto, Paychex payroll platforms

This allows us to step into your existing operations quickly, reduce transition friction, and boost automation for maximum seasonal workload efficiency.

One of Aone’s most powerful operational advantages comes from our global delivery model. By operating across multiple time zones, Aone ensures that work submitted by US teams at the end of their business day is processed and returned overnight.

This essentially doubles your daily capacity during seasonal peaks. What would normally take several days internally can be completed in 24 hours or less with Aone’s overnight processing, allowing CPA firms and businesses to meet extremely tight deadlines without sacrificing quality or accuracy.

During peak tax season or year-end close, this speed becomes a game-changing advantage for both small businesses and large accounting firms.

The seasonal workload crisis in US accounting isn’t going away. In fact, it’s only becoming more severe as regulations grow, talent shortages widen, and client expectations rise.

Aone Outsourcing Solutions gives businesses and CPA firms the ability to expand their capacity instantly without compromising quality, compliance, or profitability.

If you’re tired of losing sleep every tax season, burning out your internal staff, and scrambling for temporary help that never fully delivers, it’s time to explore a smarter solution.

Grab a One-Month Free Trial…

At the time of tax season and year-end, firms face sudden spikes in tax filings, reconciliations, and compliance work. Most lack enough trained staff to handle the surge, causing delays, burnout, and errors.

Q2: How can outsourcing help CPA firms manage peak seasons?

Outsourcing allows firms to instantly scale their team with trained professionals. They handle tax prep, compliance, reconciliations, and reporting, reducing internal pressure while meeting tight deadlines.

Commonly outsourced tasks include tax returns (1040, 1120, 1065), multi-state filings, sales tax returns, year-end close, reconciliations, payroll filings, and audit preparation — all high-volume, deadline-driven work.

Yes. Firms like Aone follow strict security protocols (SOC 2, encryption) and comply with IRS, GAAP, and state regulations. Client confidentiality and legal compliance are fully maintained.

Q5. How quickly can an outsourced firm like Aone ramp up for busy seasons?

Aone can onboard qualified accountants in 5–10 business days, far faster than in-house hiring. This helps CPA firms handle sudden workload spikes without operational delays.

Aone’s teams are trained on QuickBooks, NetSuite, Xero, UltraTax CS, Drake Tax, ProConnect, Sage Intacct, ADP, Gusto, Paychex, and many other US accounting and payroll platforms.

Outsourcing can save 40%–60% on labour costs. Firms avoid high US salaries, benefits, recruiting fees, and training expenses while maintaining quality and capacity.