GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Most companies in the U.S., including small businesses, startups, and accounting firms, find it both costly and time-consuming to manage day-to-day bookkeeping. Whether to monitor transactions and balance the books or maintain tax compliance, many financial activities tend to consume precious time that could be used in building the organization. Expanding overheads, scarce in-house resources, and growing regulatory requirements have created a practical and strategic need for outsourced bookkeeping services in the USA.

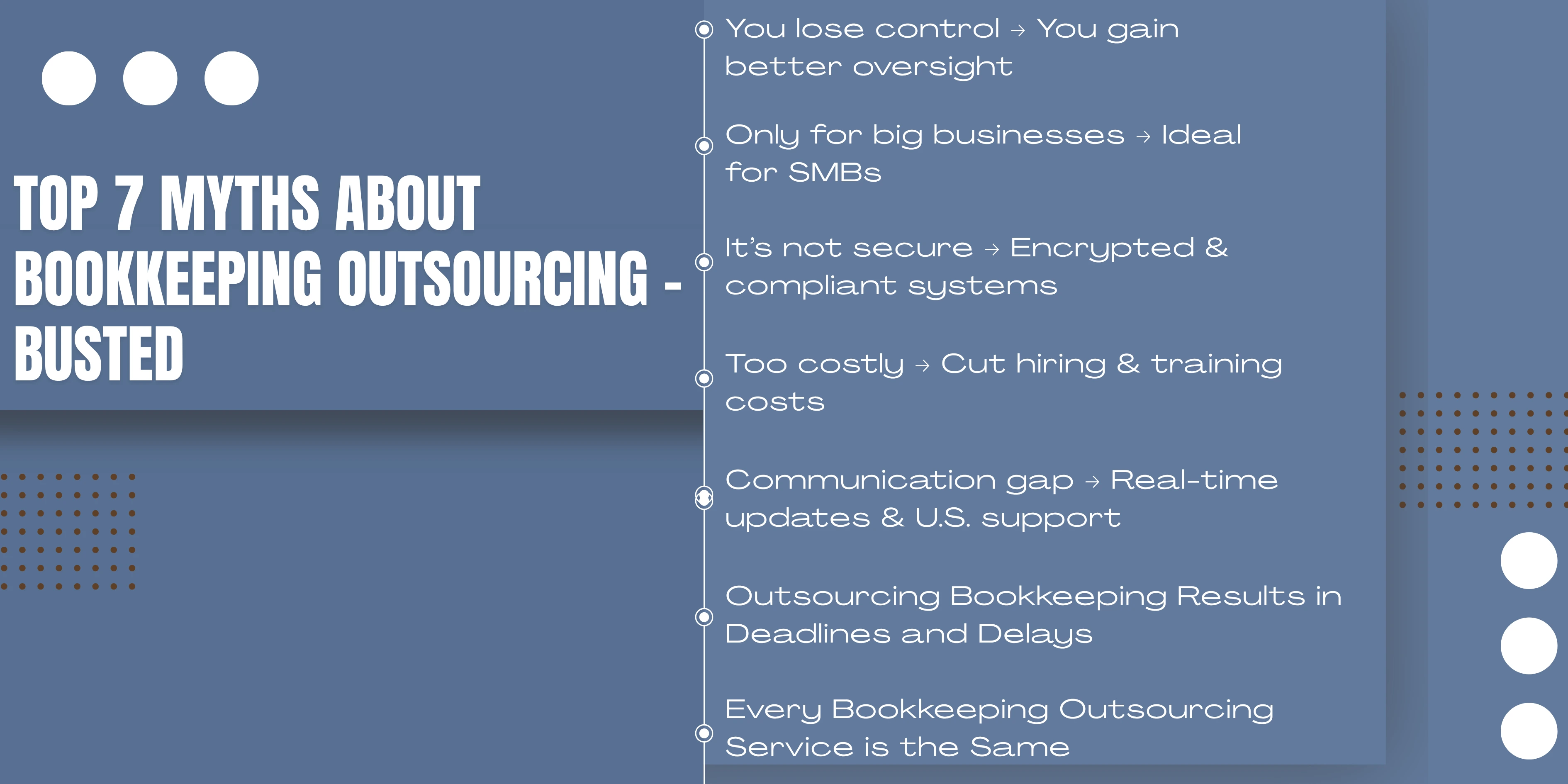

However, these apparent advantages, such as cost savings, accuracy, and scalability, cannot persuade business owners to consider outsourcing bookkeeping services, as several myths surrounding it prevent the utilization of outsourcing resources. The problem is the myths surrounding control, security, and communication, which prevent companies in the U.S. from exploring more innovative alternatives.

The following blog outlines the top 7 myths about outsourcing bookkeeping and why you should not believe them, so that you can make a future-proof decision regarding your business.

Although outsourced bookkeeping services are becoming increasingly popular in the USA, they are still not widely used by many business owners because they hold certain misconceptions. The reason is that these myths make it difficult to attract the U.S.-based companies (particularly the small and medium-sized enterprises) to take advantage of the cheap, precise, and scalable bookkeeping units.

Reality:

The primary concern that most people have regarding outsourcing bookkeeping is that it will result in a loss of control, as the bookkeeping is performed by professionals other than themselves. Using the outsourced bookkeeping services in reality provides you with better visibility and more control, rather than less. On cloud systems such as QuickBooks Online, Xero, or NetSuite, you can monitor cash flow, view real-time financial reports, and approve transactions at any time and from any place.

Reality:

Although enterprise-level companies indeed outsource financial functions, bookkeeping outsourcing among small businesses in the U.S. is fast catching up. Whether you're an individual business owner, a technology-savvy company, or a brick-and-mortar shop specializing in family business, outsourcing enables you to remove overhead, gain professional knowledge, and concentrate on what you do best.

A large number of small businesses in the U.S. are unable to afford a full-time in-house bookkeeper. Outsourcing enables one to end up with accurate books and tax filings, as well as peace of mind, at a price that does not add to the burden of payroll. Aone Outsourcing works with hundreds of SMBs across the United States, and all of the packages that the company offers are customized to your business.

Reality:

The security of your data is a justified concern; however, when using an outsourced bookkeeping business that you can trust in the USA, they invest a fair share in securing your financial data. At Aone Outsourcing, we adhere to data security best practices, including end-to-end encryption, role-based access provisioning, two-factor authentication, and compliance assessments for SOC 2, HIPAA, and GDPR.

Reality:

The myth, as far as this is concerned, is untrue. A full-time U.S. bookkeeper may cost between $50,000 and $70,000 per year (this does not include benefits, training, software subscriptions, or office space). In comparison, bookkeeping outsourcing services are a fraction of that cost; they have a variable monthly fee with no other overhead.

Reality:

There is a common misconception that working across time zones or in distributed teams will slow down the work. Nevertheless, leading outsourced bookkeeping providers catering to clients in the U.S., such as Aone Outsourcing, operate within U.S. time zones, appoint dedicated account managers, and provide seamless communication via platforms like Slack, Zoom, Microsoft Teams, and email.

Reality:

Most U.S. business owners are hesitant to outsource because they fear it will complicate closing the books or filing taxes at the end of the month. Nonetheless, professional bookkeeping outsourcing services providers, such as Aone Outsourcing, operate with specific turnaround times and outputs. You will find that you can get results much quicker, as you will have designated groups, automated processes, and operating hours adjusted to U.S. hours.

Reality:

Not all providers offer equal expertise, technology, and industry knowledge. Some general service vendors may not be familiar with U.S. tax regulations, GAAP standards, or even industry-specific bookkeeping requirements. This is why one should opt for a specialized outsourced bookkeeping service in the USA that aligns with your business objectives.

Aone Outsourcing is an organization that provides its customers with specialized bookkeeping services to support their firms across various industries, including retail, healthcare, online stores, and professional services. Some of our software includes QuickBooks Online, Xero, and NetSuite. Not only do we take care of your books, but we make you smarter.

Final Thought: A Smart Move by Modern American Companies

Bookkeeping doesn't need to consume your time, budget, or energy. Thousands of U.S. small businesses and start-ups find outsourced back office bookkeeping services a viable, economic, and secure option over staffing. When you outsource to a reputable firm like Aone Outsourcing, you also eliminate the typical headaches of manual data entry, increased payroll expenses, late filings, and outdated software.

We have discovered that the myths about outsourced bookkeeping in the USA, including poor control and security issues, are just not true. The current outsourcing solutions are designed to be transparent, compliant, and flexible. Be at it, business owner in New York, Texas, or California. Outsourcing provides you with professional financial backup without the cost.

Contact Aone Outsourcing using the contact form below today and find out how we can save you time, reduce expenses, and help you keep control of your finances in the U.S. using our easy-to-use, top-quality U.S.-based bookkeeping services.

FAQs

Businesses safely exchange financial information with their outsourcing company, which performs accounting work remotely using cloud-based platforms and tools.