GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

You expected that outsourcing your payroll would help you save money, but suddenly, surprise fees emerge as unwanted subscription renewals. The next thing you know, you are in party mode because your payroll process has just been streamlined, and then you are sitting in front of an invoice with countless extra fees you did not subscribe to.

Payroll outsourcing is a prudent and rational choice for many companies in the United States. It promises reduced administrative effort, improved compliance, and faster payment to staff members, while also allowing for a focus on growth. Nevertheless, the potential savings may soon be offset by the so-called outsourcing payroll costs, mainly when due diligence is not conducted correctly. Even the setup itself, the little extras that come with a service, can add up easily without you realizing it, and then they end up in your budget.

In the upcoming article, we will highlight eight everyday hidden expenses in payroll outsourcing, along with valuable guidance on how to avoid them like a professional. If you are a small business owner, a founder of a promising start-up, or an HR manager of an expanding company, these tips will guide you to a payroll partner that is truly transparent and cost-effective.

The market for payroll outsourcing has undergone significant changes. In the post-gig economy, remote work and payroll-by-technology growth cost structures are no longer straightforward. The current payroll providers tend to package their services in complicated packages, which makes it challenging to realize the extra fees that are charged until after the fact.

This ambiguity is not simply an inconvenience to the Gen Z and millennial-consumer-driven companies but an abuse of trust. These are the generations that were brought up with an understanding that everything that they utilize in the service should be automated, transparent, and economical. It is anticlimactic and amateurish to realize that when a payroll provider hides costs in the fine print, it is akin to being ghosted by a potential employer after a good job interview: a frustrating and unprofessional experience.

In the future, trends in payroll outsourcing are expected to include a growing need to utilize AI-based payroll solutions, the automation of compliance, and the development of real-time payment engines. These innovations may guarantee efficiency, but one can expect the emergence of new types of hidden charges, such as integration costs, premium features of artificial intelligence, or support modifications. It is therefore all the more important to learn where these expenses lie concealed (and how you can negotiate around them).

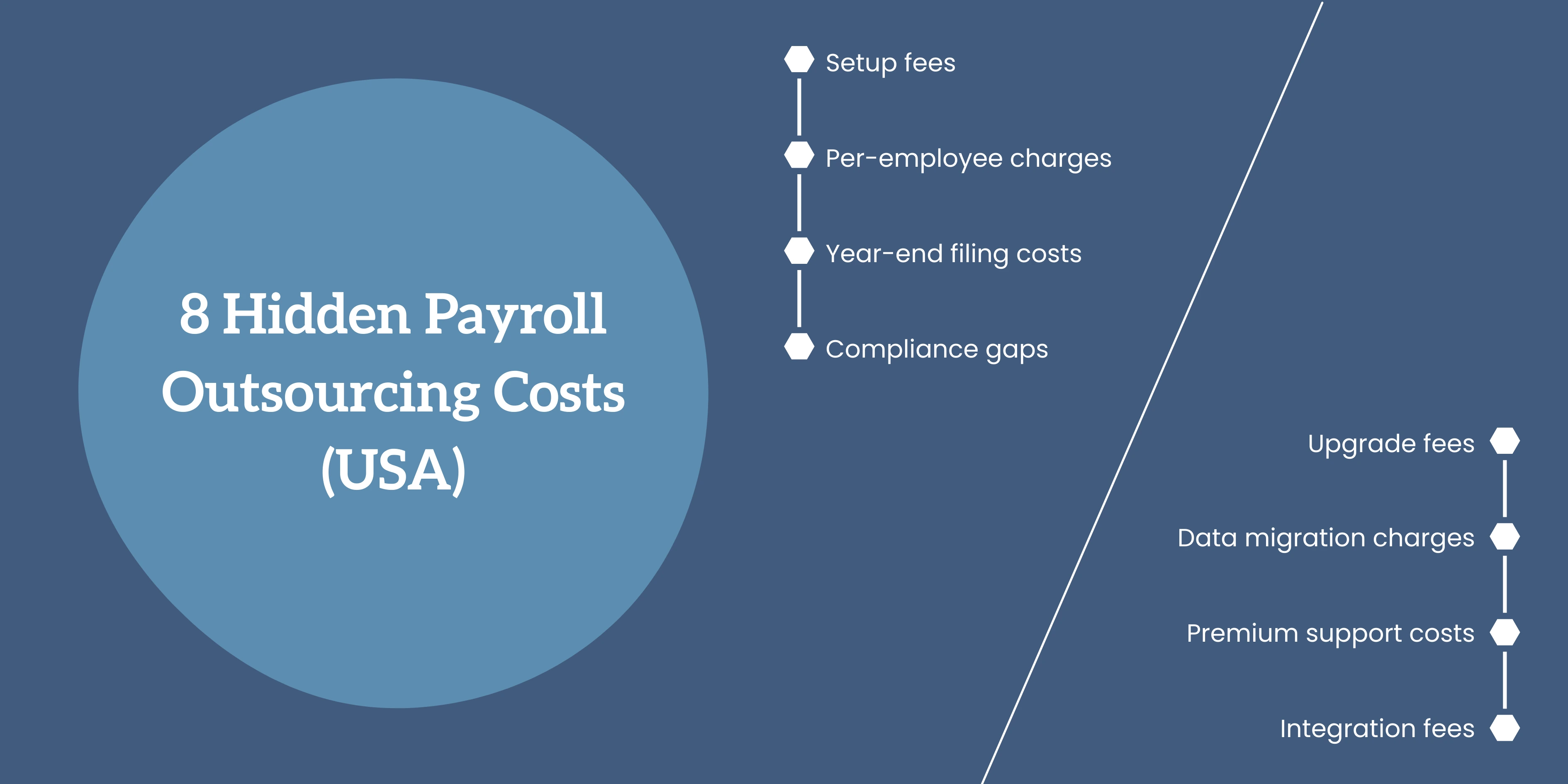

To achieve an efficiency revolution in outsourcing payroll in the USA, you must be aware of potential costs that may be lurking. Below are the eight most common payroll outsourcing fees to be aware of, along with practical examples on how to avoid them.

Most payroll vendors require high upfront costs to integrate their systems, input workers' data, and perform initial setup. This may be hundreds, even thousands of dollars, that dig into your budget without you realizing it until you receive your first paycheck.

Real-life Scenario: You enter into a contract that contains a promise to pay, most likely a lower monthly fee of $200, and you open the first bill to see a $1,000 setup charge added. It is akin to purchasing a phone plan and being charged an activation fee after the fact.

How to Avoid It: The best way to avoid it is to request transparent pricing beforehand and negotiate that it is included in the basic price in the form of onboarding. Select providers that offer payroll services with zero setup fees or seasonal promotions.

Some payroll solutions operate on a per-employee basis, so the more employees you have, even as your workload remains the same, the more you pay.

Real-life Scenario: Your startup grows in size from 10 to 25 people during a year, and your payroll bill increases by more than double with no additional value added. It is like your rent is increased simply because you brought more friends home.

How to Avoid It: You can prevent this by searching for flat-rate payroll pricing structures or plans that do not penalize them for growth. Always consider how rates will vary when our team expands.

End-of-year reporting (W-2s, 1099s, and ACA compliance) incurs an additional cost. They are typically not included in your standard payroll charges.

Real-life Scenario: December comes, and you want to find a surprise bill of $300 to “prepare the tax form.” It is the payroll provider saying Happy Christmas.

How to Avoid It: To prevent this issue, ensure your service package includes year-end tax filing. Otherwise, estimate those expenses in advance so you are not caught by surprise.

Not every payroll supplier reimburses fines occasioned by mistakes in taxation returns, although they were the cause. This may result in unexpected penalties from the IRS.

Real-life Scenario: Your payroll taxes are misfiled by your provider, and you are fined $500. When you want your money back, they can cite some fine print in the contract that releases them of any liability.

How to Avoid It: Look for providers that offer a tax penalty guarantee and carefully review the terms of liability before signing.

It may be a matter of basic functions, such as direct deposit, printing custom reports, or mobile access, that have an added charge.

Real-life Scenario: You assumed that direct deposit is standard, but your provider charges you $2 each time. Instantly, there is a convenience cost.

How to Avoid It: Ask to provide a complete list of services included. Choose comprehensive payroll solutions that come together with the features you need and are not nickel-and-dimed.

It may be costly to leave a payroll provider and export employee information, historical payroll information, and government records.

Real-life Scenario: You change providers, in the interest of a better deal, only to be subsequently charged a $600 data retrieval fee - in other words, having to pay to see your information.

How to Avoid It: Research data ownership and exit fees before signing. Select a provider which have free data migration or simple export possibilities.

Not all providers offer free support for introductory emails, calls, or live chats. Additionally, priority service may be an optional extra.

Real-life Scenario: When payday arrives, payroll issues arise, and the live agent can only be contacted by purchasing a premium support package. Your employees are frustrated, and so are you.

How to Avoid It: Ensure that your plan offers unlimited support across multiple channels. The question is how quickly problems are solved on standard versus premium plans.

Integration between payroll software and HR systems, benefits platforms, or accounting applications may require custom solutions with custom pricing.

Real-life Scenario: You need your payroll to connect to your QuickBooks, and the vendor is asking an additional $500 to set it up.

How to Avoid It: Seek providers that offer pre-existing integrations of the tools you employ. Determine the integration costs during the initial consultation to avoid any surprises.

When analyzing payroll outsourcing services within the USA, you may be ready to buy the headline price, but it is the small print that will put you on guard. The following are three of the big warning signs to look out for before entering a contract:

When you have to be armed with a CPA and a magnifying glass to read the pricing structure of your provider, this is an issue. Hidden costs not reflected in complex pricing structures may include per-transaction fees, seasonal costs, or other types of processing fees.

Tip: Opt for flat rates and transparent payroll pricing when available.

What most providers do is offer an attractive low base rate and quietly upsell you once you are signed and want to use direct deposit, compliance tracking, or reporting tools, services, which most businesses do not even question, considering them optional.

Tip: Request to see the list of included versus optional services and have it in writing before signing.

Payroll onboarding is where the most mistakes occur, and without powerful technology support, these mistakes can lead to complications in the process, compliance risks, and significant expenses. Other vendors skimp in this area, often offering support with limited functionality or providing support only through email.

Tip: Select a payroll partner who can support your onboarding process in real-time via phone, chat, or video call, ensuring a seamless transition.

The fine print of modern transparency culture not only leads to financial loss but also to a loss of trust. Companies headed by Gen Z and millennial leaders will not tolerate any hidden parameters when conducting any kind of services, and lacking this cannot be considered modern and professional.

Not all no-hidden-fee payroll providers are the same, however, and it requires more than a low-price payroll quote to determine whether a company adheres to (or aspires to adhere to) these new rules. Over here is what to look at:

These are setup, monthly service, end-of-year filings, integrations and exit fees. An open provider will not have a reason to be secretive.

Plans offered at a flat rate, including standard payroll, tax filings, and direct deposits, lower the chances of receiving surprise invoices.

Ensure your provider has the flexibility in its terms and does not penalize you in the event you add employees or relocate to other states.

Artificial intelligence-based payroll compliance alerts eliminate the high costs of tax inaccuracies and get you ahead of the curve on regulatory changes.

Payroll outsourcing can do more than simply save time; it enables companies to enhance efficiency, accuracy, and compliance. There may be no visibility with your low-cost partner, and feel free to cut your cost package into a bloated expenditure program. Identifying red flags and understanding the actual expenses of payroll outsourcing in the USA, along with selecting a supplier that prioritizes honesty, can help you save on your bottom line and ensure the business runs smoothly.

At Aone Outsourcing, payroll is designed to be easy, open, and stress-free. There are no hidden gotchas during setup, no fine print - just quality service tailored to the individual.

Willing to make your payroll simpler and lose the dark figures?

Call us now at Aone Outsourcing or schedule your free, no-obligation consultation to discover payroll solutions that work within your business and budget.

Because in payroll, peace of mind is money, and every cent spared counts.

Payroll outsourcing in the USA can range from $20 to $200 or more per month, depending on the number of employees, the services involved, and the pricing schemes offered by the provider. Before signing, always look out for the hidden fees.

Among these risks are issues of data security, loss of control over the processes, compliance failure, and unforeseen expenses in cases where the provider lacks transparency or accuracy.

Applicable expenses include setup costs, monthly charges, per-user charges, end-of-year filings, integration costs, and exit costs.