GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Are the finances of your startup turning into a liability rather than an asset? In several U.S. startups, there is a potential for damaging and expensive mistakes associated with balancing core business activities with the effort to maintain accurate financial records. The founders will be unable to concentrate on scaling their business due to time constraints, funding constraints, and a lack of in-house accounting knowledge. Poor financial management, under these highly competitive circumstances, has the potential to destroy even the most creative startup-inspired ideas within a very short time.

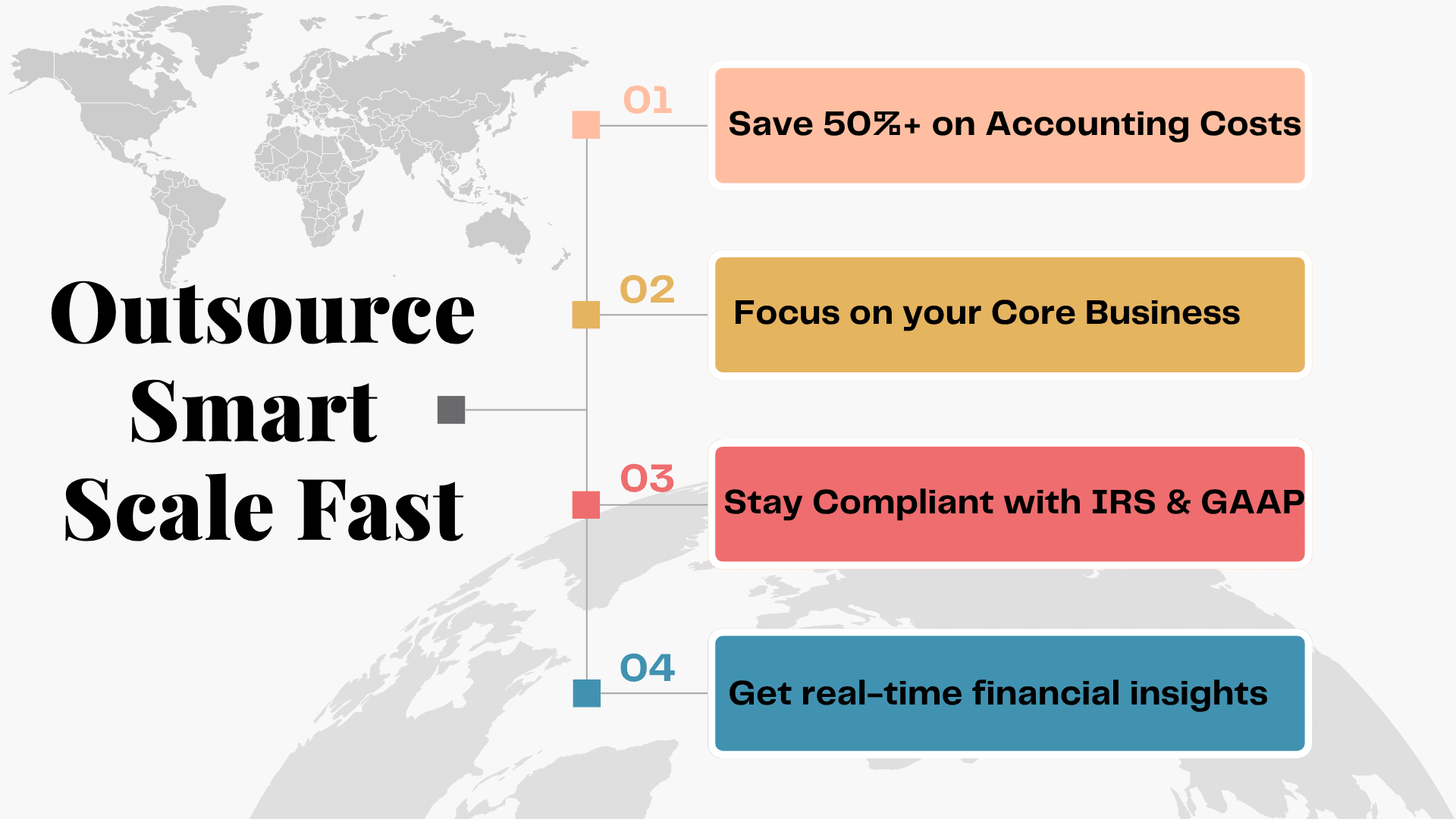

This is where outsourcing accounting services for startups can play a significant role. A startup does not need to hire full-time accountants or establish a finance department because it can always outsource bookkeeping services, tax filings, payroll, and financial statements to professionals who specialize in these areas. The services these providers offer are scalable, technology-enabled accounting services that cater to the accounting needs of early-stage businesses, ensuring they have visibility into cash flow, compliance with regulatory demands, and the ability to produce investor-ready financial statements —all of which reduce overhead expenses.

No matter how hard you work, no matter how many accountants you hire, you can never guarantee IRS compliance, GAAP accuracy, or confidence in investors operating within the U.S. startup ecosystem. That is why outsourcing your accounting remains more than a convenience; it is a growth strategy. With access to real-time data and professional financial advice, startups will be able to make more informed decisions based on the data and feel more secure about funding rounds, audits, and expansion strategies. In this blog, we will find out how outsourced accounting and bookkeeping services in the USA can make your startup larger, more innovative, and more sustainable in terms of scaling.

Outsourcing accounting in the U.S. is not just about cost-cutting in startups; it is a strategic financial optimization that achieves financial clarity, reduces risk, and enables faster scaling. Outsourced services can assist you at all stages in the following ways.

U.S. startups have limited funds; therefore, it is not feasible to hire full-time accounting professionals, such as CPAs, controllers, or financial analysts. When you outsource accounting to a startup, you have a well-educated set of specialists, U.S. tax laws, GAAP compliance, and economic strategy expertise, with the advantage of large accounting firms without the cost of in-house staffing.

These third-party professionals provide strategic financial planning, precise business forecasts, and tax-saving advice that is otherwise unavailable to start-up-type firms. Startups can ensure that every time they make an economic decision, it is based on experience and accuracy because they have designed a cheaper and more flexible model that replaces their need to hire skilled employees within the company.

Paying employees, accounting, and paying taxes can be a time-consuming drain on the most valuable resource for a founder. Under the conditions of outsourced bookkeeping and accounting services, U.S. startups can avoid spending time on financial operations and concentrate on activities that drive their growth, such as product development, customer acquisition, and fundraising.

Outsourcing standard but important financial work to professional performers ensures that nothing goes unattended and frees up internal resources. This change not only increases overall productivity but also enables founders to make timely decisions that affect the business. Outsourcing accounting saves startups the time to focus on innovation and growth, allowing them to redirect that energy and time to more productive tasks, such as managing spreadsheets and meeting tax deadlines.

The financial requirements of any startup are dynamic, ranging from startup accounting to financial modeling as the business grows. When firms outsource U.S. start-ups' accounting services, they pay on flexible terms. As the firm grows, the accounting functions also expand in scale, without requiring significant hiring or reorganization of the financial team.

Whether you have a few transactions in process or are looking to launch a funding round, outsourced providers will scale their services to your timetable and pace. This scalability not only helps in saving time and money, but it also means that your business will scale with your financial infrastructure. When considering an offshore accounting company, you will be assured that handling your business is possible without the administrative hassle of adding staff to the internal accounting department.

The issue of adhering to IRS rulings, GAAP formulation, and ambiguous tax laws has always been a challenge for U.S.-based startups. There is a likelihood that one mistake on your tax returns or your financial statements can result in a penalty, audits, or even a loss of reputation. Outsourcing accounting services to startups enables them to access expert professionals knowledgeable in federal and state tax laws, accounting guidelines, and business-related financial requirements.

These professionals will ensure that all entries, deductions, and records are accurate and prepared to withstand an audit, thereby minimizing your risk of non-compliance. Startups can utilize outsourced bookkeeping and tax support, working with confidence knowing their financials are handled in full compliance with U.S. laws and best practices.

In modern times, each startup requires real-time insight into its financial well-being to make quick, fact-based decisions. By utilizing cloud-based accounting offerings from outsourced companies, the start-up industry in the U.S. can access financial reports, dashboards, and key performance indicators in real-time from anywhere at any time. These tools enable monitoring of cash flow and KPIs, as well as identifying financial problems before they become too big.

Most importantly, good financial reporting fosters confidence among prospective investors and partners. Constant visibility provided by outsourced accounting services for startups will enable founders to make smarter decisions, maintain adequate budgets, and build investor confidence at pivotal stages in the business or when raising funds.

The estimated cost of hiring an in-house accountant is between $60,000 and $80,000 per year (excluding benefits, training, and programs). In the case of the majority of startups in the USA, this amount is not a sustainable investment. By outsourcing your accounting function, your company can access professional services using a fraction of the resources required to build an internal team of finance personnel. This approach can save your company 40-60% of the costs associated with creating an internal group of financial experts.

Such economical accounting services enable start-ups to conserve further finances, which they can then invest in products, marketing, or recruiting new employees who can generate income. Offering themed, flexible pricing scales and packages, outsourced accounting services provide startups with an affordable solution to maintain proper financial control without compromising on quality.

A startup can be killed before it starts by financial mismanagement, fraud, and data breaches. In the USA, outsourced accounting services establish firm internal controls, safeguarded processes, and clear working arrangements that protect your business against these misfortunes. These firms are meticulous in every transaction, ensuring accuracy, accountability, and security through the use of role-based access controls and automated audit trails.

They will also regularly conduct reconciliations and internal reviews to ensure your books are accurate and error-free. For startups preparing to undergo due diligence or external audits, professional organization of their financial systems makes the process less stressful and more credible. Concisely, outsourcing will not only enhance the process of efficiency, but it will also put your startup in a better financial position.

The idea of outsourcing accounting services is not solely a financial decision, but a strategic one that enables U.S. startups to grow faster, smarter, and without hesitation. In addition to the ways outsourcing accounting and bookkeeping services saves time and cuts overhead, there is also increased expertise, regulatory compliance, and instant strategic advice that are important to consider when scaling up a contemporary business. Working on IRS regulations, reporting to investors, and addressing numerous other related issues, outsourcing is a solution that enables the startup to stay current and concentrate better on what is truly essential: creating an efficient and sustainable venture.

Here at Aone Outsourcing, we are in the business of empowering startups in the U.S. with more innovative financial management and helping them reach their full potential. Organizing your books to reduce expenses, ensure a higher rate of accuracy, or anticipate funding, we can assist you at every stage. We will take care of your numbers so that you can bring your vision to life.

A. Yes, a large number of U.S. startups outsource their work to Indian companies to obtain cost-effective, professional-level accounting, taxation, and financial services, all in compliance with U.S. rules.

A. Outsourcing the accounting may cut expenses by up to 60 percent and eliminate costs such as salaries, benefits, and software, while guaranteeing professional support.

A. It offers competitive pricing, expert financial advice, strict compliance, and real-time reporting, along with flexible and scalable accounting services as your startup grows.

A. Identify reputable companies, such as Aone Outsourcing, through LinkedIn or Clutch, or by word of mouth. Ensure the provider has a significant portion of experience in the U.S. market and utilizes cloud-based solutions.