GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

Managing bookkeeping can be both laborious and add to the stress that small business owners feel from their various roles. Daily transactions, including all purchases and expenses, and maintaining financial records can become a significant challenge for businesses without an accounting team.

Outsourced bookkeeping services help small companies use experts to stay on top of their finances and make fewer errors. Expert help and useful online resources help make outsourcing your accounting and bookkeeping a smoother and less stressful process.

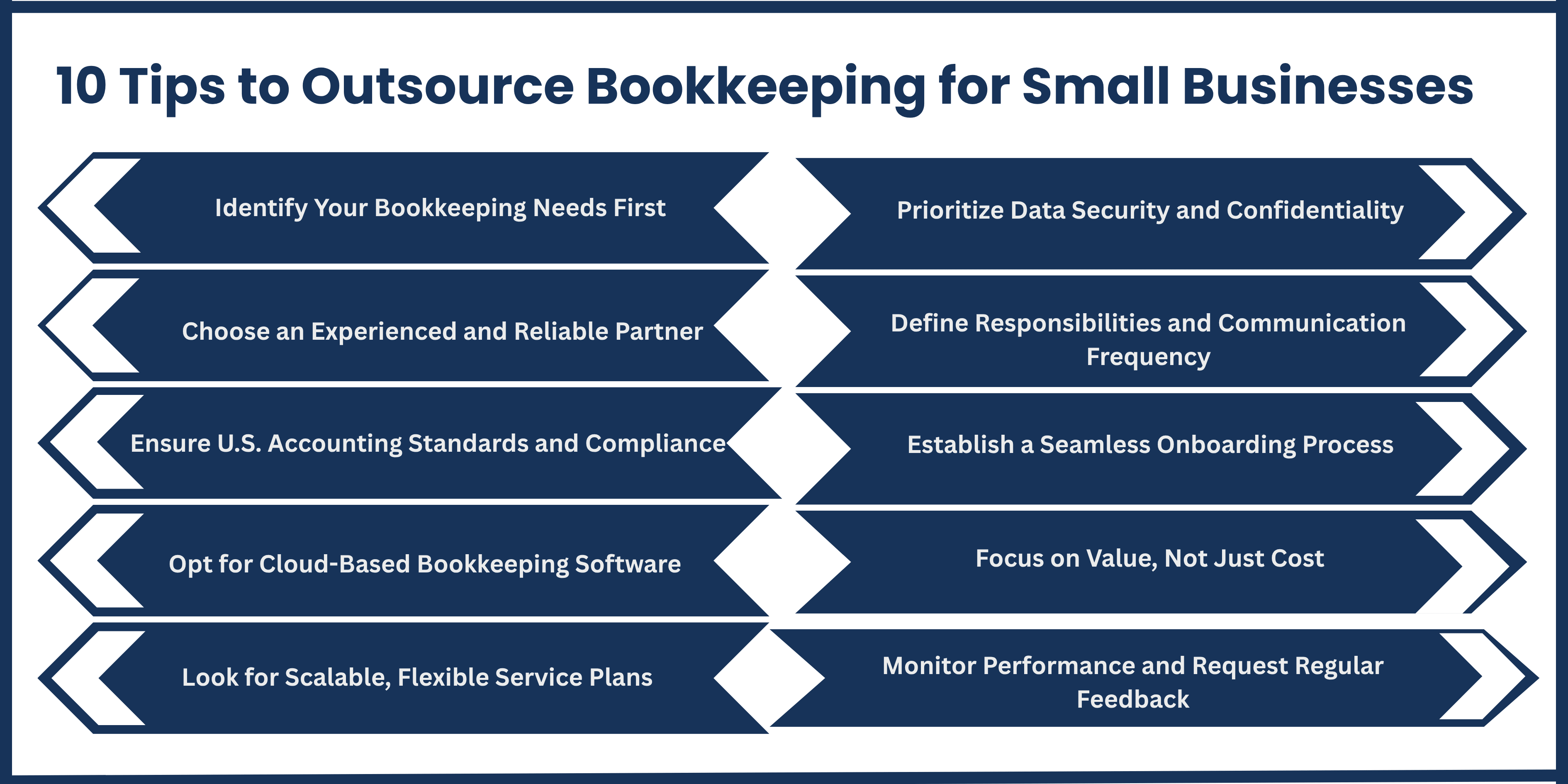

We have compiled 10 expert tips that will make your outsourced bookkeeping simple and effective, helping your business stay properly organised and healthy.

First, ensure you understand the bookkeeping services your business requires before selecting an outsourcing service. Routinely, someone in this occupation looks after accounts payable, accounts receivable, bank reconciliations, payroll processing, and tax preparation. It is possible that a business will need to keep track of cash flow or deliver financial reports every month.

Listing your needs will make it easier to select a provider that can give you the right combination of features. You can also avoid paying for features you don’t use or not spotting the ones you need the most.

We customise our professional bookkeeping services at Aone Outsourcing for the benefit of small businesses. If you are looking for all types of accounting or just a few special services, we will make sure our solutions suit your budget.

When you are outsourcing bookkeeping solutions, you should be careful, since not every company is the same. It is important that your partner recognizes U.S. accounting rules, regulations for your sector, and all the necessary compliance obligations. Trusting an experienced provider will help you avoid problems, keep on time, and ensure all financial reports are correct.

For years, Aone Outsourcing has provided dependable online bookkeeping for many small companies in the United States. Everyone on our team understands U.S. GAAP, IRS standards, and the latest cloud-based bookkeeping software tools to give you quality and dependable service.

Make sure that the company you work with in outsourced bookkeeping uses GAAP and IRS guidelines. Bookkeeping errors might cause you to owe taxes, face audits, and encounter legal problems, especially related to sales tax, payroll taxes, and the necessity to report each year.

The outsourced accounting service you choose should monitor new regulations and guarantee your books are always correct, on time, and prepared for audits.

We ensure that our team is fully skilled in both U.S. accounting principles and compliance with laws at Aone Outsourcing to provide you with all the benefits of outsourcing bookkeeping. We focus on helping American small businesses, ensuring all their outsourced accounting and bookkeeping work, including accounts payable and taxes, is in line with today’s American law. Aone makes sure your finances are well looked after and follows all rules.

Using modern cloud-based bookkeeping solutions is no longer an option—it’s required today. Cloud platforms give you instant, safe access to your finances from any gadget, so you can work with your bookkeeper and manage your business money at any time and from anywhere.

When using cloud-based solutions, businesses experience added accuracy and transparency because their data is automatically entered and integrated, and they can review previous transactions. Because of these features, you won’t have to worry about errors, accounting tasks are done sooner, and you instantly know about how much you are owed, have spent, and your profit.

With QuickBooks Online, Xero, and NetSuite, Aone Outsourcing helps you integrate their cloud platforms with what you have already set up. If you’re just beginning online bookkeeping or want to improve your current financial control, our team will smoothly transition you to cloud services.

When your business grows, the way you handle finances will need to change. Thus, you should look for an outsourcing partner that can quickly change and link their accounting and bookkeeping services to your needs. No matter if you add new staff, open new stores, or bring in extra services, your bookkeeping should scale appropriately.

Find a provider that lets you choose packages for different types of support, which you can scale as required without impacting your daily work or the budget.

We create custom plans at Aone Outsourcing to match your business at every stage. If your requirements are only basic bookkeeping or a full accounting solution, we help you conquer growth while managing your finances carefully. We offer a flexible system so that you only have to pay for what you want, when you want it.

Safeguarding your private financial information should be your biggest concern when arranging for bookkeeping services. Your provider needs to use advanced security measures, including encryption from start to finish, secure data centres, and multiple types of passwords to log in. Also, make sure your partner signs NDAs and sticks to formal and rigorous access guidelines for internal data.

If someone accesses your system without permission, it often results in large financial and reputational losses. That’s why it’s best to choose security providers who take serious steps to safeguard their clients’ data.

Ensuring data protection is important to us at Aone Outsourcing. All our systems rely on strong encryption, dependable cloud storage, and effective login processes to keep your financial details safe. To protect you, we respect confidentiality and set strong internal rules that stop unauthorised access to your information as you grow your business.

Any successful outsourcing partnership relies on everyone knowing their roles and communicating routinely. You should immediately determine which tasks will be given to your outsourced partner, such as accounting, reconciling, monitoring finances, or tax preparation. Because everything is clear, there are no repeats, no misunderstandings, and all deadlines are hit.

Plan a schedule for you to get updates, reports, and reviews frequently. Receiving financial summaries regularly gives you important information while stopping you from focusing on details you don’t need to see.

All communication with clients and the creation of reports is managed by the dedicated person assigned to each client by Aone Outsourcing. We design reporting schedules that fit your needs, so you’re always informed about your finances, as clear as day, with no sudden changes.

You should not find that outsourcing adds unnecessary complexity to your business. That’s the reason why making onboarding easy is essential. The proper provider will walk you step by step, helping you gather the important documents, establish online bookkeeping, create your business processes, and understand your main financial indicators.

Completing onboarding with ease means your team is less affected, and your financial records do not get outdated. It also helps you gain confidence and supports the growth of a lasting relationship.

We ensure that onboarding activities are quick and easy here at Aone Outsourcing. From the start, our team guides you through implementation, helping maintain proper software flow, quick document movement, and little time spent without the systems. We manage to get everything installed and working before your business is affected by disruption, then you can continue doing what you do best.

Handing over your bookkeeping services to outside help can save you money, although make sure you’re getting top-quality service. Although buying through the cheapest company may sound appealing, hiring a provider with poor service can lead to simple errors, late deliveries, and expensive fixes.

A better idea is to judge how well they perform their job:

Is everything done correctly and with attention to detail?

Do they help you with your questions and supply meaningful information on finances?

Are they freeing up your time and easing up on your team’s tasks?

We do more at Aone Outsourcing than just bookkeeping. We take care of your financial recording, showcase important trends, and give useful tips for making good cash flow and budgeting decisions. You get more than accounting and bookkeeping with Aone, you gain a partner who helps you grow your business financially.

You should not use outsourcing accounting and bookkeeping as an excuse not to monitor your finances. Make sure to look at your company’s performance regularly to make the best use of your partnership. Be sure to check accuracy rates, see how fast you can deliver a report, and note the number of times errors or changes are made. They make it easier to check if your program is designed to meet your provider’s targets.

It helps to arrange frequent review sessions to check if your company’s needs are still being addressed. During your conversations, make requests for changes in your service, more features, or how reporting is done.

Transparency is very important to us at Aone Outsourcing. We send complete performance results, hold frequent talks, and invite feedback to help us improve our services. We hope to get better at supporting you as your business develops over time.

Outsourcing bookkeeping is not just a matter of convenience; it helps businesses be more efficient, makes fewer mistakes, and gives them an advantage over others. When you have a good partner, you spend less time worrying about finances, get your time back, and can concentrate on advancing your company.

Small businesses come to us at Aone Outsourcing for expert bookkeeping services, practical support, and online books that help them succeed financially.

Looks like you’re ready to hand over your bookkeeping and get more time back for yourself?

Let Aone Outsourcing know if you need expert, secure, and professional services created for small business bookkeeping.

Outsourcing your bookkeeping could be the game-changer your small business needs.

Contact Us